Financial Adviser Insights, Sep21, 2023

Adviser Numbers This Week, Net Change of (-30) Moving down From 15,709 to 15,679

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

Join our Members Lounge - Click Here For Membership Information -

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

The number of advisers decreased by (-30) in a busy week, with over 90 advisers affected by some form of change. Net loss of experienced adviser is (-40), as this week we had 10 new entrants.

Key Adviser Movements This Week:

Net Change of advisers (-30)

Current number of advisers at 15,679

Net Change of (-119) for Calendar YTD

Net Change new Financial YTD +116

23 Licensee Owners had net gains for 30 advisers

26 Licensee Owners had net losses for (-60) advisers

1 New licensee and 1 ceased

10 New entrants

Number of advisers active this week, appointed / resigned: 95.

Growth This Week - Licensee Owners

Sequoia Group up by net 3, all advisers joining its Interprac licensee. Picking up 2 advisers from Nextgen (Financial Link Group)and an adviser returning after a break

A new licensee commenced with 3 advisers, after the practice left Merit Wealth

Templestone up by 2, both advisers moving across from Nextgen

Plan 2 up by two advisers, both new entrants

Centrepoint also up by 2, one moving across from Nextgen and the other from Consultum

18 licensee owners up by net 1 each, including Morgans, Guideway, and AIA.

Losses This Week - Licensee Owners

Insignia down by (-24). The losses driven by their licensee Bridges, a salaried licensee, which saw 23 advisers come off the ASIC FAR this week. At this stage, none are showing as being appointed elsewhere, and we are not sure if they have been ‘let go’ by Insignia or being transitioned. Insignia via Consultum did authorise 2 new entrants - The losses at Insignia are mounting. As disclosed by insignia a short while ago, they are reevaluating their advice offer, and we can expect further disruption over the coming weeks / months. This year alone, Insignia are now down (-112), almost 3 times the losses at AMP Group which has the next highest loss at (-40).

Financial Link Group (Nextgen) is down (-7) and now only has 11 advisers.

FSSSP (Aware Super) down by (-6). None of the advisers are currently showing as appointed elsewhere. The losses at FSSSP have contributed to the Super Fund model as having the greatest losses in percentage terms YTD at (-5.31%). The advice market in total is down by (-0.75%).

A tail of 23 licensee owners down by (-1) each including AMP Group, Diverger, Fiducian and WT Financial Group.

Financial Adviser Exam Results (Dashboard 8 Adviser Fast Facts )

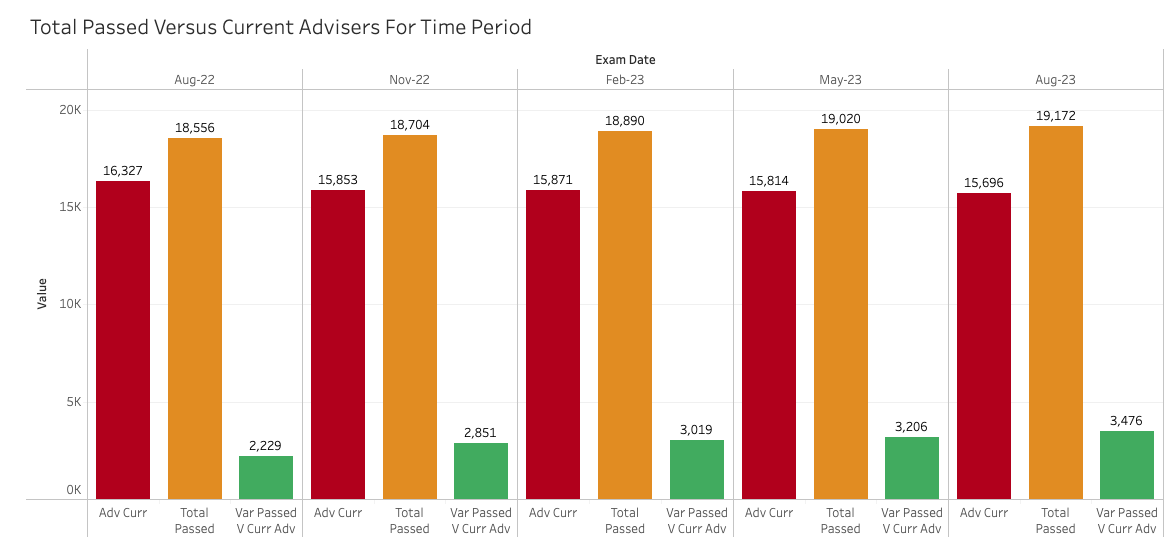

ASIC recently announce the results of the most recent Financial Adviser exam. Below we have put forward a couple of charts looking at the recent history going back to the exams for Aug 2022.

The first chart shows that the pass rate has jumped from 52% back in Aug 2022, to its highest pass rate of 73% for Aug 2023. However, Aug 2022 was a very different time, with the majority of advisers sitting for at least a second time.

The last two sets of exams have produced very similar number in terms of the number of candidates, those sitting for the first time and the pass rates. Maybe this now becomes the norm for a while?

Financial Adviser Exam - Stats from Aug 2022 to Aug 2023

The lower chart highlights the gap between the number of candidates that have passed versus the number of ‘current’ advisers at the time of the exam. Back in Aug 2022, there was a ‘surplus’ of 2,229 of people / advisers eligible to practice versus current advisers. That surplus has now grown to 3,476 which is 22% of the current advisers for Aug 2023.

We are aware that many advisers passed the exam and still exited shortly afterwards. For example, this calendar year alone, 713 advisers have ceased on the ASIC FAR, all would have passed the exam. Many are being replaced by advisers coming back into advice. However, we can see that there is a big opportunity to bring many more advisers back into advice.

Number of Candidates Passed Exam Versus Current Advisers (At Time of Exam)

Did you see our Adviser Gross Revenue Post?

If you missed it, click on the link below.

Have a great week and checkout the

Members Lounge for all of your data needs - Click on box below