Financial Adviser Market Insights, Dec 19, 2024

Adviser Numbers Increased By 8, Moving From 15,507 To 15,515

Click Here To Access Limited Free Adviser Dashboard

Welcome to the last update for 2024. We will restart on January 9. We are expecting the Christmas / New Year period to be volatile, but the full data won’t flow in until mid-January.

To all our readers, subscribers and members, we thank you for your support and wish you all the best for Christmas and New Year.

Weekly Summary

As expected, we have seen a boost in adviser numbers driven by new entrants / advisers following the Financial Adviser Exam results being released. This week, 16 new entrants were added to the ASIC FAR. We also had one new licensee, one ceased and a total of 70 advisers were affected.

Need More Data?

Join our Members Lounge - Click Here For Membership Information -

First Month at 50% off - Use promo Code 50%Month1

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements This Week:

Net change of advisers +8

Current number of advisers at 15,515

Net Change Calendar 2024 YTD (-108)

Net Change Financial YTD +172

33 Licensee Owners had net gains of 35 advisers

18 Licensee Owners had net losses for (-25) advisers

1 new licensees commenced and 1 ceased

16 New entrants

Number of advisers active this week, appointed / resigned: 70.

Growth This Week - Licensee Owners

Two licensee owners up by two:

Count Limited with their Count licensee picking up an adviser from Oracle Advisory Group and one from Lifespan.

Beryllium Advisers with one adviser from Synchron , owned by WT Financial Group and another adviser from Findex.

A very long tail of 31 licensee owners up by net one each including; Unisuper, Sequoia, Lifespan and Bell Financial Group.

Losses This Week - Licensee Owners

Insignia group down by four, all leaving Bridges and to date, none appointed elsewhere

Rhombus down by three; two of the losses yet to be appointed and one joining CT Group Advisory Services

Morgan Stanley and NAB Bank both down by two, none of the four advisers being appointed elsewhere to date

A tail of 14 licensee owners down by one each including Alteris Financial Group, Infocus and WT Financial Group.

Calendar and Financial Year To date.

As we near the end of the year, all indications are that we will end up in the red, currently running at a loss of (-108), but in a better position than 2023, which was at (-140) for the same time period.

We are expecting more new entrants to join the FAR, but the last week of December is popular for retirements and advisers resigning who will often join a new licensee at the start of a new year. The losses are likely to offset the gains from new entrants.

On a positive note, the financial year to date (see screenshot from Adviser Fast Facts below) is looking very strong. The start of the financial year is always strong, given a boost by advisers resigning at the end of the financial year and commencing in a new licensee, often their own licensee, in July.

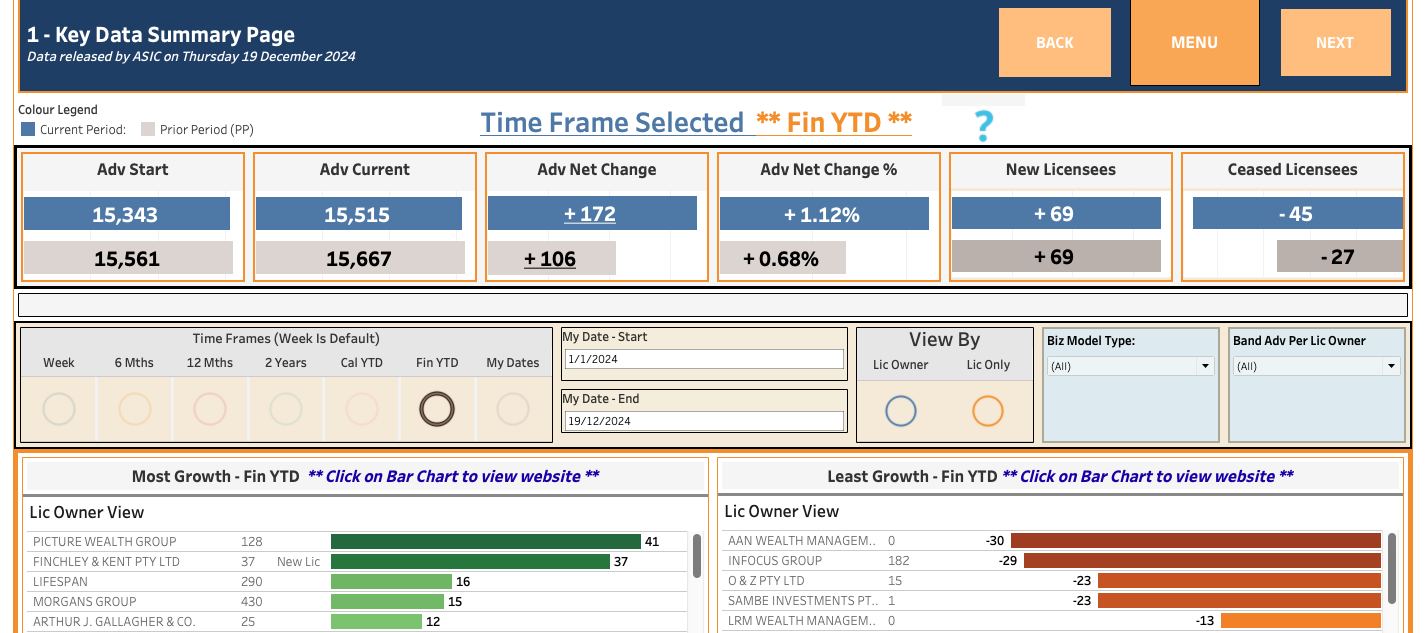

The net change is currently running as +172, compared to +106 for the equivalent time period last year. The number of new licensees is exactly the same as 2023 at 69, but ceased licensees have increased from (-27) to (-45.)

Picture Wealth after winning advisers across from AAN Wealth Management, are topping the list for growth at 41. Finchley and Kent at 37. On the least growth, AAN Wealth are now ceased and down by (-30). Infocus down by (-29). However, some of the losses are technical in nature, after a deal struck with Clime and the advisers will be serviced by Infocus.

Financial Year To Date Data - Adviser Fast Facts Dashboard

Super Fund Assets By Fund Type - Why Retail funds ave recently outperformed Industry funds?

On November 28, we published our analysis of the APRA Superannuation by Fund Type dataset. We found that retail funds have been performing better than Industry funds and other types recently.

Last week, APRA updated the asset allocations for the funds. The data reveals that Industry funds are increasing their equity allocation faster than Retail Funds, albeit starting from a lower level, which may explain their underperformance.

We have updated our initial analysis View - Superannuation By Fund Type Analysis - Retail Funds Fighting Back with the new data.

For our members, we have also updated the Member Super Funds By Fund Type dashboards.