Financial Adviser Insights, June 13, 2024

Adviser Numbers This week - Decreased by (-9), Moving From 15,606 To 15,597

Weekly Summary

Financial adviser numbers went negative for the week and took the total to below 15,600, now standing at 15,597. The net numbers were down despite another four new entrants. No new licensees this week and two ceased.

Need More Data?

Join our Members Lounge - Click Here For Membership Information -

First Month at 50% off - Use promo Code 50%Month1

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements This Week:

Net change of advisers (-9)

Current number of advisers at 15,597

Net Change Calendar 2024 YTD (-18)

Net Change Financial YTD +41

16 Licensee Owners had net gains of 21 advisers

23 Licensee Owners had net losses for (-30) advisers

No new licensees commenced and two eased

4 New entrants

Number of advisers active this week, appointed / resigned: 49.

Growth This Week - Licensee Owners

Capstone were up by four advisers, gaining three advisers from AMP and another adviser coming back into advice after a short break

IA Advice up by two, with both advisers moving across from Crest Wealth Advice owned by Capital Accounting Trust

Australian Retirement Trust also up by two, with advisers coming back after a break

A tail of 13 licensee owners up by net one each including: Oreana, Lifespan and Bell Financial Group.

Losses This Week - Licensee Owners

Capital Accounting Group (Crest Wealth) down by four advisers and the licensee down to zero. As mentioned above, two joining IA Advice, another joined NWG Financial Planning and and the reminder yet to be appointed

Four licensee Owners down by two advisers each:

AMP Group - Appointing one new entrant but losing three advisers

Centrepoint - Losing one each from Alliance Wealth and Matrix

Guideway - Losing two advisers yet to be appointed elsewhere

Viridian - Losing one adviser to Templestone and the other yet to be appointed elsewhere.

A tail of 19 licensee owners down by net one including: Insignia, Morgans Group and Mutual Trust.

Members Lounge - Adviser Fast Facts Dashboards - Updated

With a very busy period of adviser movement just around the corner, as we finish the financial year and start a new one, it’s more important than ever to stay ahead of the curve. The Members Lounge is the place to be.

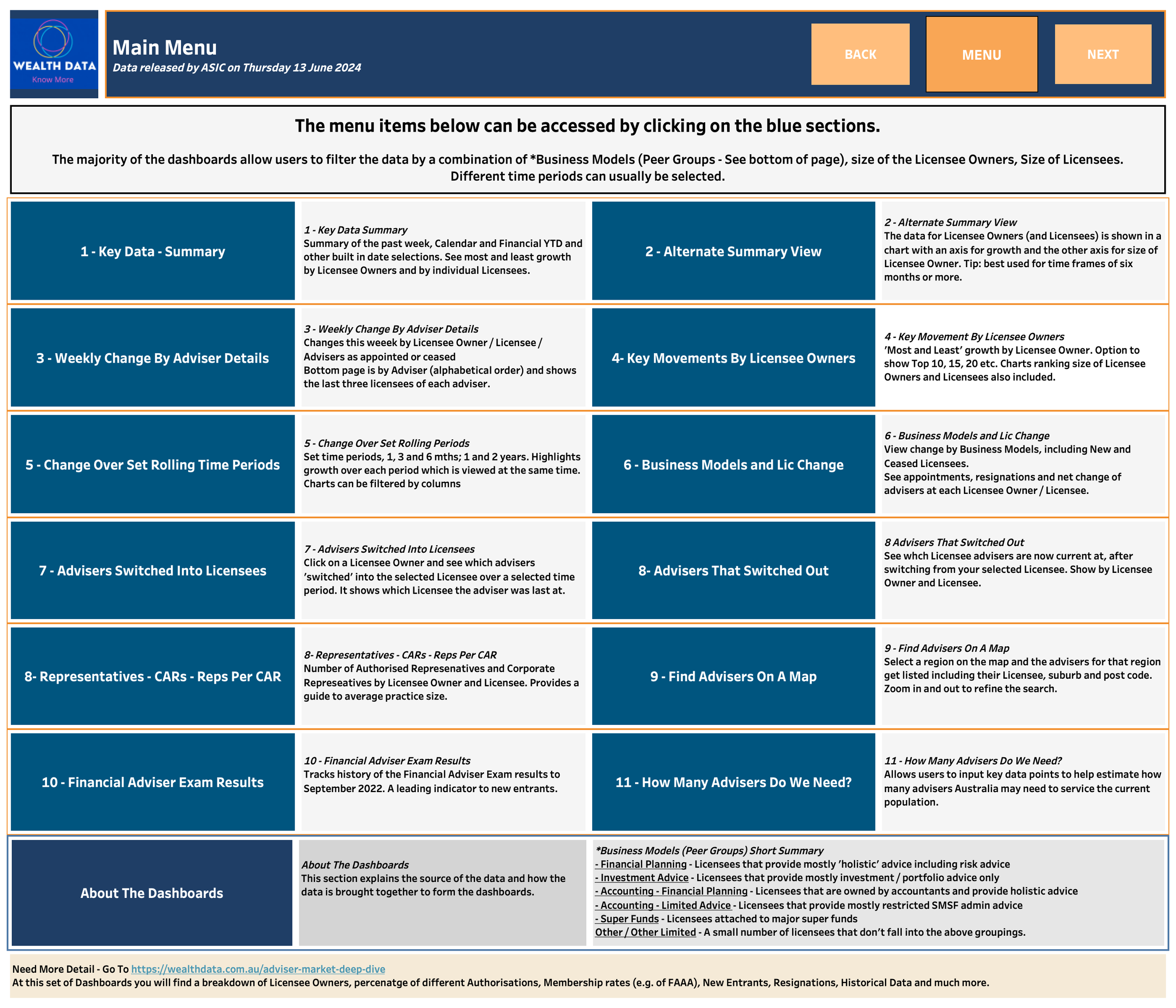

We have updated the very popular Adviser Fast Facts series of Dashboards. We have added a full menu screen that assists in identifying what each dashboard can do for you. With one click, you get the data you need.

You can start with the first month at half price. You are not locked into any long term contracts.

New Menu Page For Adviser Fast Facts Dashboards

Please Note: The Licensee Deep Dive Dashboards will be updated over the next few days

Retail Funds Bounce Back

APRA's latest data to March 2024 reveals key shifts in the superannuation landscape:

Retail funds do it again: For the second quarter in a row they outperform their peers for investment returns

Industry funds see increasing SMSFs Net losses: Transfers to self-managed super funds (SMSFs) are accelerating for Industry funds.

Pension payments for Industry funds: rapidly increasing

Advisers benefit: The strong quarter for superannuation across the board presents growing opportunities for financial advisers.

All details in the post - See The Post here

Members have access to the full range of dynamic dashboards - To join and get the first month at half price - click here for more info on the Members Lounge

Financial Adviser Landscape - Presentation - Free Download

Last week, I presented at the FNW ‘Advice, Wealth and Super Rewired’ conference. Below, you can access the presentation for free. There are a number of charts that cover:

Financial Adviser Movement back to 2017

Calendar YTD movement including most growth / the least growth firms

Share price movement over five years of ASX listed firms associated with financial planning / wealth

The growth and impact of Micro AFSLs

New entrants - year by year

Gross revenue of advisers

Adviser opportunities - Growth of super and much more.

Our ‘FREE’ dashboard - ‘Super Fund Stats’ - Super Funds At The Fund Level, has been updated with all dashboards added including coverage of SMSF data where applicable. The full set of dashboards have been available to members since early Feb this year.

To access the FREE Super Fund Stats - Click Here