Weekly Financial Adviser Movement, Dec 1, 2022

Number of Advisers decreased by (-30) from 15,894 to 15,864

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

Join our Members Lounge - Click Here For Membership Information -

Special offer: 50% Discount applies for first month of membership during December - Simply enter 50%MONTH1 when prompted at sign up.

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements This Week:

Net Change of advisers (-30)

20 Licensee Owners had net gains for 24 advisers

38 Licensee Owners had net losses for (-54) advisers

5 new licensees and (-11) ceased

1 Provisional Adviser (PAs) commenced and none ceased.

Summary

The first week of heavy losses in a while prompted by the closure of small licensees, (see more below) and only the one new Provisional Adviser.

Growth This Week

Limited growth numbers this week with only 20 licensee owners having net growth and five of them being new licensees (Details provided to members). A new licensee commenced with 3 advisers, all moving away from Synchron, now owned by WT Financial Group. Perpetual up by 2 with both backdated to June 2022.

Centrepoint also up plus 2, with one coming back after a break and a new entrant but not classed as a Provisional Adviser. 17 licensee owners are up net 1 including Steinhardt (Infocus) who picked up one adviser who was previously at Aware Super, Fiducian, Findex, AAN Wealth management and the remaining 4 new licensees.

Losses This Week

MCA Financial Planners down (-6) with 4 yet to be appointed elsewhere. MCA commenced the year with 34 advisers and are now down to 11. Insignia down net (-4) after losing 5 advisers and gaining 1. Australian Administration Service (Link) down (-3) and none appointed elsewhere and WT Financial Group also down (-3), all losses at Synchron. WT Financial Group are down (-279) advisers or (-37.60%) for the calendar year.

Four licensee owners, AMP, Diverger, Fortnum and Fitzpatricks down net (-2) each. A long tail of 30 licensee owners down a net (-1) including all 11 closed licensees.

Licensees backdating adviser resignations

Of the 11 licensees that closed (down to zero advisers), 10 had adviser resignation dates backdated to Jan 1, 2022. This is obviously not a coincidence. In February this year, ASIC responded to a senate economics committee and stated that they will follow up with AFSLs who are not reporting advisers who should be removed from the ASIC FAR, as a result of not passing their FASEA Exam. We did see a large number of small licensee closures during May and June with advisers’ resignations backdated into Dec 2021.

This current batch of advisers who are being removed may be related to the same matter. However, it does raise some glaring concerns into the current AFSL reporting sytem, for allowing many advisers to remain on the FAR for so long. The very popular Moneysmart website, operated by ASIC, in its first sentence under the heading ‘Getting the right advice’ states “Make sure your financial adviser has an Australian financial services (AFS) licence. Check their qualifications on the Financial Advisers Register”. Obviously, some advisers are showing up as qualified even though they have not passed the most critical of exams monitored and now managed by ASIC.

I guess many will be asking if the advisers have given any advice since Jan 1, 2022 and if so, what are the consequences. And of course, how and why has it taken so long for ASIC to catch up with the licensees. It may well be that smaller licensees need extra support and closer monitoring, because if they are getting the basics wrong, what else is going on in the business. It is an odd situation, whereby in many instances across small licensees, the financial adviser is also the licensee owner, compliance manager and in charge of client complaints. A few conflicts one might say.

What’s in a name?

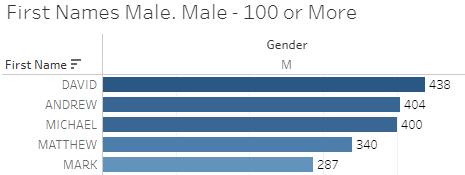

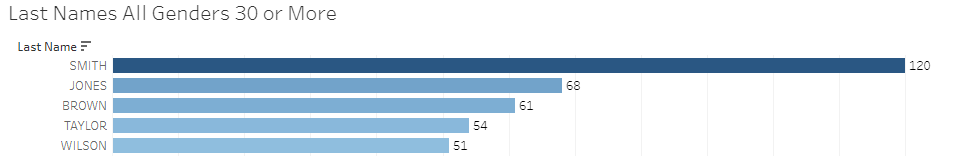

After last week’s analysis of the gender mix across advisers, today we look at some names. See dashboard 10B Licensee Deep Dive. Below are the most common first names, female and male, and surnames. The dashboards give a lot more detail.

David is out in front for first names, while Smith is easily the most popular last name, probably neither are a surprise to most readers. However, the more complete listing at the dashboards may have a surprise or two.

Financial Newswire’s Rating the Rating Houses - Survey Now Open for the Adviser Market

Here is your chance to rate the ratings houses and we would really appreciate your contribution. It is a short five-minute survey which will greatly help advisers, licensee owners and the rating houses to better understand what’s important to the end users - the advisers and licensees.

Information collected is confidential and a summary of the results will be published upon completion. To commence the survey click on the image below. For any questions, please contact Yasmine Masi of Financial Newswire via email yasminemasi@financialnewswire.com.au

Members get get all this information plus see movement of advisers into individual licensees at the dashboards - Join Today

Have a great week and checkout the

Members Lounge for all of your data needs - Click on box below