Financial Adviser Movement to Feb 2, 2023

Number of Advisers decreased by (-26) from 15,867 to 15,841

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

Join our Members Lounge - Click Here For Membership Information -

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements This Week:

Net Change of advisers (-26)

Net Change of plus 23 for the start of the new year

20 Licensee Owners had net gains for 25 advisers

22 Licensee Owners had net losses for (-50) advisers

1 new licensee and zero ceased

6 Provisional Advisers (PAs) commenced and 1 ceased.

Summary

The initial numbers are disappointing after a solid start to the year. However, we can confirm that a large portion of advisers lost this week have switched licensees and will reappear on the ASIC FAR soon.

Growth This Week

ASVW Holdings continue to grow and are up by four after picking up a practice from Consultum (Insignia). Terrell C. G. Hyman (Alpine Financial Advice) a small firm that started in late 2022, picked up an additional two advisers from Synchron (WT Financial). Canaccord also up by two with one adviser coming back after a break and Provisional Adviser.

A total of 17 licensee owners had net gains of one adviser each including Viridian, MBS Advice, Marsh Mercer and the one new licensee.

Losses This Week

Bombora advice is down by (-14). However, this would appear to have been structured last year after Zurich Assure purchased the ANZ Life Insurance business, including advisers and ‘parked’ them at Bombora until such time Zurich Assure could commence its own AFSL. We are expecting the advisers to reappear soon under Zurich Assure.

Australian Unity are down by eight advisers after they lost a large NSW practice that has commenced its own AFSL. The advisers should reappear next week under that AFSL. Our members are given the details in their post. Insignia down by seven, as noted earlier, they lost four advisers to ASVW. In total Insignia lost eight advisers and gained one.

WT Financial down by three advisers and a tail of 18 licensee owners down by net one including AMP Group, Clime Group, Morgans and Picture Wealth Holdings.

The Last Three Months - Charts and tables from: Adviser Fast Facts Dashboard 2A

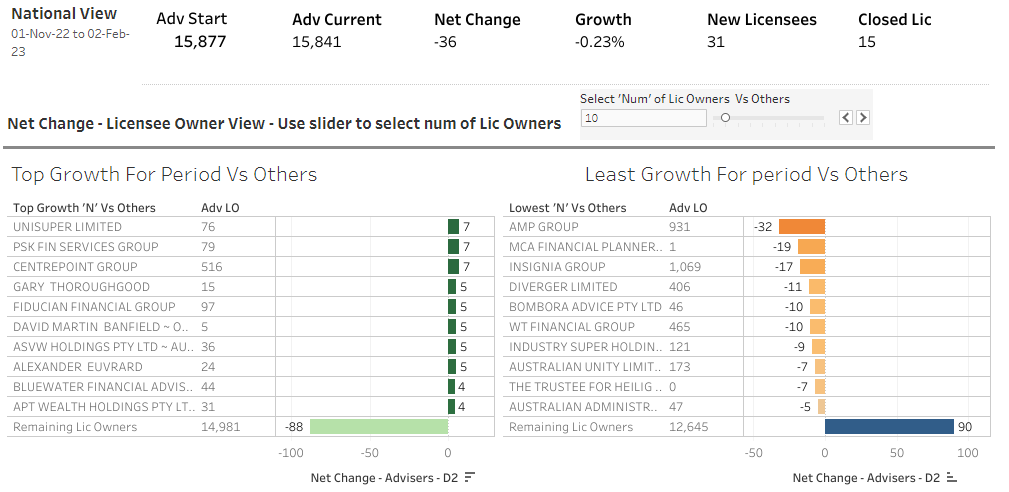

The last three months (Nov 1, 2022 to Feb 2, 2023) covers an interesting period of time. The final losses from the Financial (FASEA) Exam had washed through in October and the time period covers Christmas and new year which is typically quite volatile. The data shows a net loss of 36 Advisers along with 31 new licensees being established and 15 closed.

The charts highlight the top 10 most and least growth licensee owners and ‘the remaining licensees owners ‘grouped’ as one. As for growth, the numbers are relatively low with no clear stand-out licensee owners. Three licensee owners are up by net seven, followed by five at net five and two up net four. The remaining licensee owners (as a group) are down by net (-88).

As for least growth, AMP Group lead the list by some margin at (-32) and then a gap to (-19) for MCA Financial Planners and Insignia next at (-17). Outside of the 10 least growth, the remaining licensee owners are up by 90.

While it is still early days, it is an indication that the market has levelled out a fair bit. Some of larger groups still represent the largest losses but not by the margins we have seen over recent times.

Note: Our dashboards are mostly interactive and the charts can be changed very easily for the dates and number of license owners that may best suit your own research needs. Contact us for a full demo.

Top and least Growth (Top 10 of each) - Remaining licensee owners are grouped as one.

ADV LO = Number of current advisers at each licensee owner.

Have a great week and checkout the

Members Lounge for all of your data needs - Click on box below