Weekly Financial Adviser Movement - Feb 24, 2022

Number of Advisers decreased by (-16) from 17,298 to 17,282

Click Here To Access The Detailed Adviser Dashboards

New Dashboards

We have redesigned the dashboards with the goal of making it easier and quicker to view the data that you want to see. You will note that number of dashboards have been reduced.

Will be increasing the range of dashboards during next and introducing a paid service to access the new dashboards. Non paying subscribers will have limited access to the data. Stay tuned.

One tip with the new dashboard’s – they are longer. On most screens, you will need to scroll down to see all the data.

Key Movements This Week:

Net Change of advisers (-16)

30 Licensee Owners had net gains for 43 advisers

31 Licensee Owners had net losses for (-51) advisers

2 new licensees commenced and (-5) closed

7 Provisional Advisers (PA) commenced and (-2) ceased.

Note: For more information on each licensee, visit the dashboards and ‘hover’ your cursor on each chart to see additional data points.

Summary

After two weeks of gains we have now slipped back into negative territory. It was a relatively quiet week with less movement between licensees than previous weeks. That said, there are some interesting groups to follow as their businesses take shape for the year ahead. Most of our readers fall into the ‘holistic financial planning’ peer group and there is some good news here - this peer group is actually up plus 9 for the YTD.

Growth This Week

Dashboard 1A - Licensee Owners.

PSK which is a large financial business that operates mostly under the Charter AFSL, is now bolstering the numbers at ‘IPAC’, which PSK recently purchased from AMP. While it is showing growth of 8, the advisers appointed this week are also authorised at PSK. Will be interesting to track this business over the coming weeks.

A new licensee commenced with 3 advisers (not shown on charts, contact us for details). This was a business attached to Fitzpatricks which showed them as losses last week.

Another new licensee commenced with 2, moving away from Charter. Oreana gained two including 1 Provisional Adviser. Count also up net 2, gaining three advisers, all ex CBA advisers and losing 1 adviser. Castleguard (Lifespan) up plus 2. Thereafter, 24 were up net 1 including Fitzpatricks, Capstone, and Steinhardt (Infocus).

This week, 15 licensee owners with less than 20 advisers made gains. Or to view it another way, half of the licensee owners that made gains were small firms.

Losses This Week

Craigs Investment Partners down (-8). This firm is based in NZ and the advisers have limited authorisations for securities advice here in Australia. Insignia down (-6) this week, losing (-7) and gaining 1. Of the (-7) losses, 4 have been reappointed elsewhere.

Industry Super Holdings, better known as IFS are down (-4) after recent gains. Another industry fund advice business, FSSSP better known as Aware Super down (-3). AMP group down (-2) as were Synchron.

NAB group also down (-2) with losses at JBWere. Worth noting that the NAB group is showing at total of 274 advisers with 176 at JBWere. The balance of the advisers are under the NAB brand. However, based on their authorisations, they do not provide traditional financial advice. They are focused on FX and derivatives. Therefore, they do not sit in our financial planning peer group.

24 licensee owners down (-1) including Centrepoint, Perpetual and Picture Wealth.

5 licensees closed (down to zero advisers), 1 provided holistic advice, 3 limited advice attached to accounting and 1 non advice business. all only had 1 adviser before closing.

13 of the licensee owners that lost advisers had less than 20 advisers, including those that closed. The balance of 18 licensee owners that had net gains for the week had more than 20 advisers.

Year To Date Data

See dashboard 2

For licensee owners that have 20 or more advisers, Count continue to lead the way with 21. Castleguard (Lifespan ) continue to make gains and up 14 for the year. PSK is building rapidly with a gain of 13. Diverger also off to a good start with a gain of 10.

There are now 34 licensee owners who have 20 more advisers with positive net growth. A total net growth of 121 advisers between them.

As for losses, Insignia lead the way down (-42) and represent more than half of the total net losses for the entire market which stands at (-72).

AIA Group are down (-9), many leaving to join Count. Four groups down (-8) each including Craigs and Findex.

39 Licensee owners are showing net losses YTD. Total losses of advisers at (-163) between them.

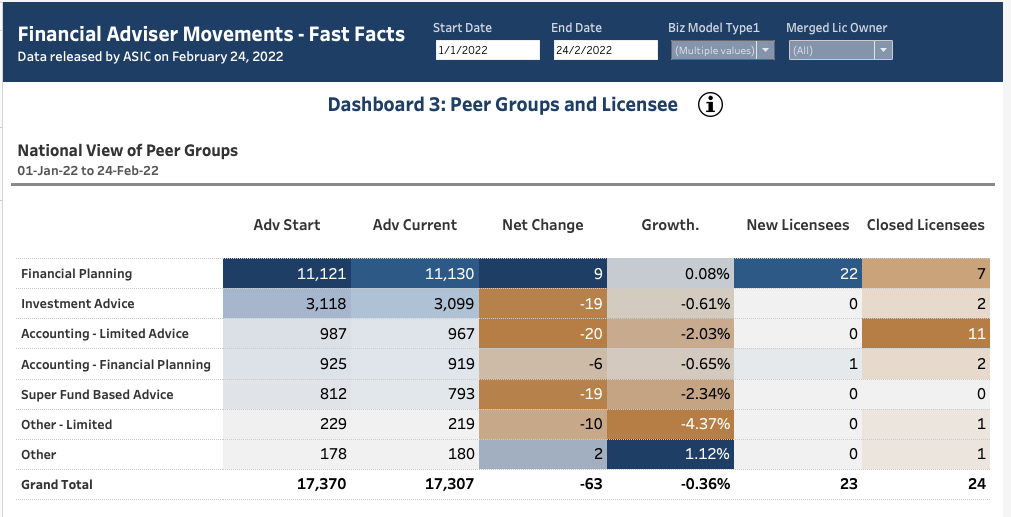

Dashboard 3 - See image below, which highlights peer groups shows that the largest peer group – Financial Planning (offer holistic advice), is showing a net gain of 9 advisers which is good to see. What is also significant is that 22 new licensees have been established YTD for the Financial Planning peer group and 7 have closed.

Most of the growth this year in actual advisers for the financial planning peer group has been driven by a combination of new Provisional Advisers and advisers who lost roles last year and are now being re hired. For example, many of the former CBA advisers.

The Financial Planning Peer Group (offers holistic advice) is growing YTD at plus 9.

Are You Looking For Advisers, Practice and Licensee Owners?

We continue to expand and refine out database to help you ‘target your market’ for finding advisers, practice owners and licensees that you need to grow your business.

For more information - Click Here

Have a great week