Financial Adviser Movement to March 9, 2023

Number of Advisers increased by +10 from 15,850 to 18,860

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

Join our Members Lounge - Click Here For Membership Information -

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements This Week:

Net Change of advisers +10

Net Change of +51 for 2023 YTD

27 Licensee Owners had net gains for 38 advisers

21 Licensee Owners had net losses for (-27) advisers

2 new licensees and 2 ceased

5 Provisional Advisers commenced and zero ceased

Number of advisers active this week (appointed / resigned) 72.

Summary

As predicted last week, we saw many of the advisers who ceased last week renter the ASIC FAR as they transitioned to new licensees and boost the net gain to +10. Calendar YTD is looking very positive at +51 especially when compared to the same period back in 2022 when it was showing (-642).

Growth This Week

A relatively new licensee Dirigere Advisory picked up 6 advisers, most moving away from Lifesherpa (Money Sherpa).

A new licensee commenced with 5 advisers with a practice moving away from Hillross (AMP Group) - details given to Members

Licensee owner Jason Valentine Davis - Avana Financial Solutions up by 2 with both advisers coming back into advice after being off the ASIC Far for a few years

Financial Professional Group also up by 2 advisers with both advisers still showing as current at other licensees.

23 licensee owners were up by 1 including WT Financial Group who hired a Provisional Adviser. Insignia up by 1 after hiring an adviser from Count. Perpetual, Ord Minnett Group and Capstone also all up by 1. The remaining new licensee commenced with just the 1 adviser.

Losses This Week

AMP Group down by (-5), as mentioned above, they lost 1 major practice from Hillross

FSSSP Financial services (Aware Super) down by (-2) - both advisers not showing as current elsewhere

TAL Dai-Chi (Affinia) also down by (-2) and neither adviser showing as being appointed elsewhere

18 licensee owners down by (-1) each including Bell Financial Group, Count and Oreana. Both licensees that closed only had the one adviser each.

Gender balance in Financial Advice - See Dashboards 10A from Licensee Deep Dive

March 8, 2023, celebrated International Women’s Day and makes this an opportune time to review the current position of gender balance of financial advisers.

We have identified that 23% of all advisers as female. However, 30% of advisers post starting in 2013 (see chart below) are female and 32% of current Provisional Advisers are also female (not shown - available via the dashboard).

Gender split by the year advisers first commenced as an adviser

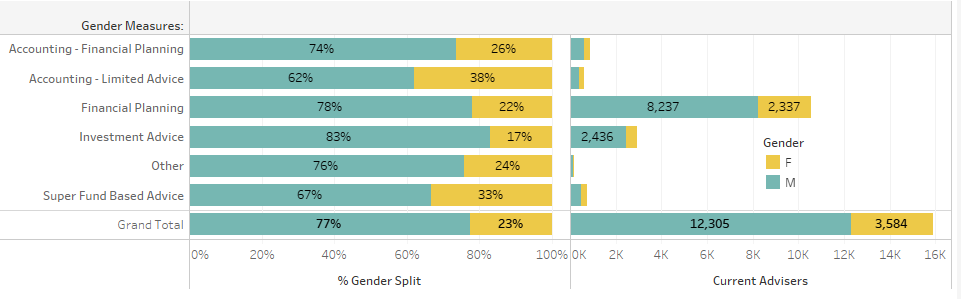

The table below highlights the splits by Business Model. The greatest level of female advisers at 38% is in the Accountant - Limited Advice model which is mostly advisers who only provide SMSF Advice and is now a very small sector of the advice market. The lowest level of female participation is in the Investment Advice model - mostly providing investment / direct advice only. This is only at 17% with several large firms in this sector at 10% or less.

Gender split by business models

Note: Members can also view gender split by State, Provisional Advisers, size of licensee owners along with viewing each licensee.

Come and join us in the Hunter for our Platforms, Wraps and Advice Technology Conference

Have a great week and checkout the

Members Lounge for all of your data needs - Click on box below