Weekly Financial Adviser Movement - Mar 24, 2022

Number of Advisers decreased by (-15) from 17,208 to 17,193

Click Here To Access Basic / Free Adviser Dashboard

New Dashboards For Members

We have now introduced new dashboards along with Adviser and AFSL Databases that are available to Wealth Data Members - Click Here For Membership Information

We now only have limited ‘free’ data on our website.

Key Movements This Week:

Net Change of advisers (-15)

27 Licensee Owners had net gains for 40 advisers

29 Licensee Owners had net losses for (-57) advisers

4 new licensees commenced and (-4) closed (Down to zero advisers)

1 Provisional Adviser (PA) commenced.

Note: Our Members Lounge - Includes a dashboard that shows by name, each adviser joining, switching and leaving a licensee for the past week - Simply sign in, click on the Licensee Deep Dive Workbook - Dashboard 7, Weekly Change Adviser Names.

Growth This Week

Fitzpatricks up 5 after winning over a large practice from AMP owned Charter Financial Planning. Chris MaCeachern (Wealth Trail trading as Freedom Finance Australia) back into growth mode after a strong 2021, up 4 this week including a practice moving across from Banyan Securities with 2 advisers.

Centrepoint Group up a net 2 advisers with Alliance Wealth hiring 4 and losing 1, while Professional Investment Services was down 1.

6 licensee owners were up net 2 including super funds Telstra, UniSuper and HESTA. Insignia also up 2 with licensees Bridges and Consultum bot hiring 1 adviser each.

19 licensee owners were up net 1 each including Picture Wealth, Fortnum, Count and Aus Unity.

4 new licensees commenced this week - details provided to our paying members.

Losses This Week

AMP Group leads the losses with (-9), most losses due to the practice moving to Fitzpatricks with 5 advisers. The balance of the losses at AMP Group have not at this stage, been appointed elsewhere.

Citi Investments (Citigroup) down (-8) and are now down to zero advisers and effectively out of providing retail financial advice. Loan Market continue to wind down and lost (-4) advisers this week and only have 4 remaining advisers. Maura McCabe (Banyan Securities) now down to 5 advisers after losing 3. Walsh Bay Partners moved to zero advisers and no longer have advisers who can provide retail advice.

Diverger and Fiducian down (-2) each and a tail of 21 licensee owners down (-1) each including Infocus, Bell Financial and Minchin Moore.

Year To Date Data - Detailed Information At The Members Lounge

Count pushes further ahead and are now up 30 for the year. Castleguard (Lifespan) remain steady at 13. PSK at 11. Diverger drop back to 9. Centrepoint, Morgans, Steinhardt (Infocus) all on 6.

As for losses, Insignia lead the way down albeit after improvement this week at (-48). Craigs after last week’s losses are at (-36), AMP Group at (-28) and WT Financial Group at (-24).

All the details above taken from our Licensee Deep Dive Dashboards available to our members.

Contestable Markets - More Complex Than Most Would Think.

Financial advisers are in demand by a range of different firms who rely on advisers to provide services and investments to the end consumer. Not so long ago, the market was much bigger with some 28,000 advisers in 2018 and the so called big six - The four major banks along with AMP and IOOF controlled access to the majority of advisers.

Now we are down close to 17,000 advisers operating across a large range of licensees. Importantly, not all licensees offer a full range of services. For example, some focus on super, risk and securities. Additionally, we also see licensees that have a broad offer, but many of their advisers have a small focus and may not for example offer investments.

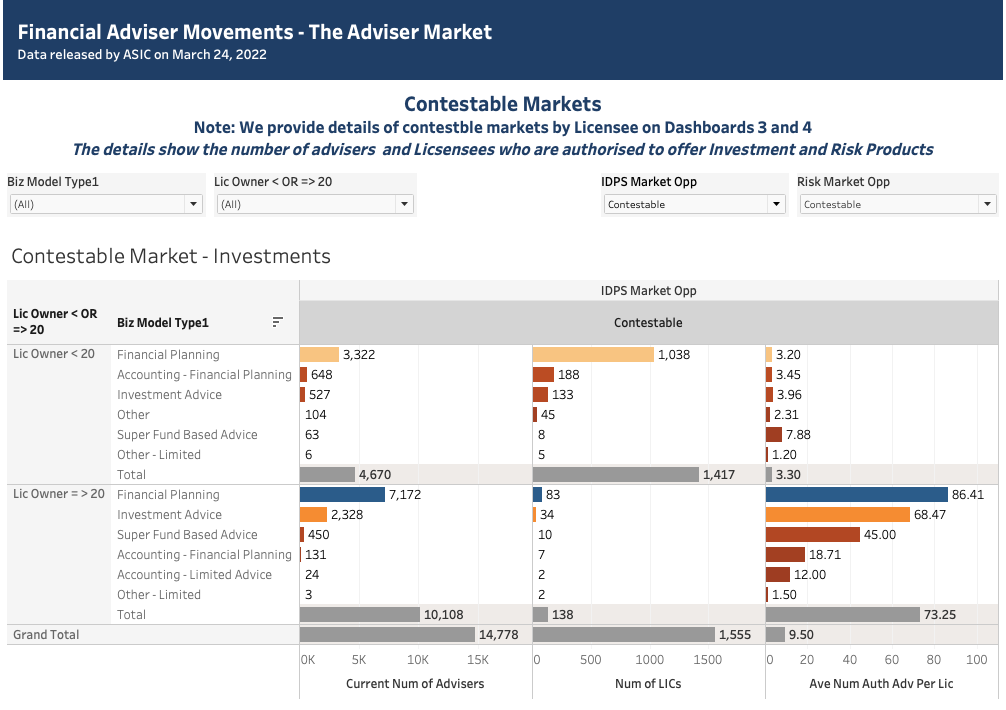

To put the above into context, we have a ‘Contestable Market’ chart for Investments - effectively, highlighting advisers that can offer investments under an IDPS / Wrap style account.

The Contestable Market - Investments Chart Highlights The Following Key Points:

A total of 14,778 are authorised to offer investments

10,108 sit in 138 licensees that have 20 or more advisers. Average of 73.25 advisers per licensee

4,670 advisers sit in 1,417 licensees with less than 20 advisers. Average of 3.30 advisers per licensee size

The vast majority of advisers can be found across the ‘Financial Planning’ business model (offer broad based advice). However, a good number sit in smaller business models, for example, 648 advisers sit across 188 licensees that are attached to Accounting groups that offer holistic advice.

To make life more complex, we are seeing new licensees added every week. So far 36 this year on top of 158 that commenced during 2021.

Chart highlighting the ‘Contestable Market’ for Investments across the Financial Adviser market

We can break these details down by individual licensees (available to paying members) and we can also offer contact details for the majority of the licensees. For more information, please call or email us if contact details are important or become a member today.

Are You Looking For Advisers, Practice and Licensee Owners?

We continue to expand and refine our database to help you ‘target your market’ for finding advisers, practice owners and licensees with contact details. Click here for more details.

With our new membership package, you now have options with different pricing to access and stay in touch with the advice market.

Have a great week