Weekly Financial Adviser Movement, May 12, 2022

Number of Advisers decreased by (-34) from 17,078 to 17,044

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

We have now introduced new dashboards along with Adviser and AFSL Databases that are available to Wealth Data Members - Click Here For Membership Information

We now only have limited ‘free’ data on our website.

Key Adviser Movements This Week:

Net Change of advisers (-34)

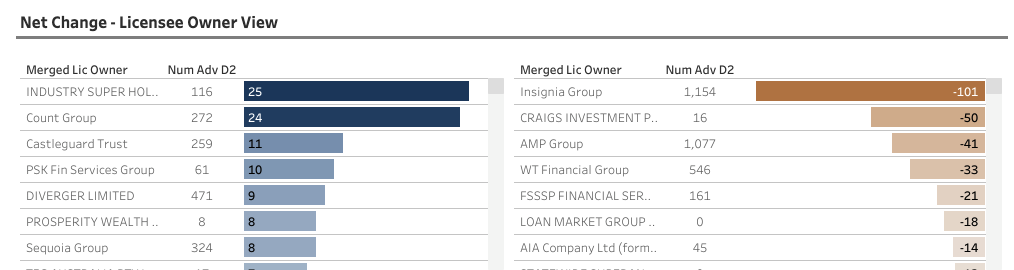

26 Licensee Owners had net gains for 38 advisers

30 Licensee Owners had net losses for (-68) advisers

2 new licensees commenced and (-13) ceased

4 Provisional Advisers (PA) commenced and (-2) ceased.

Note: Our Members Lounge - Includes a dashboard that shows by name, each adviser joining, switching and leaving a licensee for the past week - Simply sign in, click on the Licensee Deep Dive Workbook - Dashboard 7 Weekly Change Adviser Names.

Summary

Losses dominated by Insignia group losing 31 advisers, 29 at Bridges. Insignia did note in the April 26, 2022, ASX Update that under an ‘Advice simplification strategy’ that Bridges and advisers under previous MLC Advice business will be integrated. Interesting to note that the number of advisers at Insignia is at 1,154 and AMP group at 1,077. Will AMP Group regain top spot during this year? See more at Growth and Losses YTD below.

Growth This Week

Most growth this week goes to a new licensee kicking off with 5 advisers (details provided to members). Minchin Moore picked up three advisers after a merger with Professional Wealth Pty Ltd. The 3 advisers are currently authorised at both licensees for now. A new licensee with 3 advisers also commenced this week.

4 licensee owners picked up net 2 advisers including WT Financial Group adding 1 new adviser and 1 Provisional Adviser at its Synchron licensee. SDQ Investment, trading under Solace picked up 2 advisers from Morgans. A tail of 19 licensee owners picking up net 1 each including Count, Spark Partnership and Castleguard (Lifespan).

Both new licensees that commenced this week have been classed under the Financial Planning ‘Business Model’

Losses This week

As highlighted at the start of this post, Bridges, part of Insignia Group are down (-29). None are currently showing as being reappointed at this stage.

Licensee Owner Jason V Davis (Avana Financial Solutions) down (-5) with a practice breaking away. Morgans down (-3) and a closed licensee down (-2). Diverger also down (-2). A tail of 25 licensee owners down (-1) including Fortnum and Macquarie Group.

A large number of the losses were at the closed licensees. We did see 4 advisers resignations backdated into 2021. Of the 13 closed licensees, the loss of advisers accounted for 14 advisers (a small number switched). 9 of the closed licensees were in the Accounting - Limited Advice model - basically limited to SMSF advice. 3 in the Financial Planning model and 1 in the Investment Advice model.

Gains and Losses YTD

Not a great deal of change this week. At the Financial Planning model, Count still out in front with a gap to Castleguard (Lifespan), PSK and Diverger.

This week’s losses at Insignia now puts them at a net loss of (-101) YTD, 60 more than AMP Group at (-41). Insignia are currently larger than AMP Group by a total of 77 advisers. At the start of 2021, Insignia / MLC did have a combined total of 1,815 versus AMP Group at 1,488 a variance of 327. This does not include self licensed advisers who may be using services from each group.

Have a great week and don’t forget to check out our recent posts with short videos highlighting how the tools at the Members Lounge can help your business.