Adviser and Licensee Star Ratings

Last year we introduced our Star Ratings (B2B Model) and ‘tweaked’ them earlier this year post FASEA Exam. In simple terms, the Star Ratings was introduced to help our clients quickly search for advisers and licensees that had a good combination of experience and qualifications. It is driven by data collected via the *ASIC Financial Adviser Register (FAR).

While few if any rating systems are perfect, if you understand how they have been created, you can use a rating system to better understand any market.

Below we demonstrate how each adviser is scored to achieve their star rating and in turn, how individual licensees are given their rating. We also show some examples for data as of April 7, 2022.

All of this information and a whole lot more is available to everyone who have joined our Members Lounge and the data is updated weekly - Join today using the link at the bottom of this post.

How Stars are Calculated - By Individual Advisers

Each adviser is allocated stars based upon the following with details retrieved from the ASIC FAR

Stars are given per adviser as follows:

- 2 stars: 10 years plus experienced - commenced pre 2012 as an adviser

- 1 star: 5 to 10 years experience based on commencement year as an adviser

- 1 star: Have at least 1 entry as an approved qualification (For Jan 1, 2026, requirements)

- 1 star: Have at least one degree recoded under training and qualifications

- 1 star: Member of either; Financial Planning Association (FPA), Association of Financial Advisers (AFA), Association of Independently Owned Financial Professionals (AIOFP), Stockbrokers and Investment* (formerly *Financial) Advisers Association or SMSF Association

Note: An Adviser's Maximum Star Rating is 5 Stars.

How the Star Average is Calculated For Licensees

We add up the total number of stars allocated to all advisers at each licensee and divide by the number of advisers. For example, if Licensee ABC Financial Planning had a total of 100 advisers and the total stars allocated to the advisers was 350, the Licensee would have a score of 3.5 (350/100).

How Do Licensees Rank?

The following tables and data are taken from ‘Licensee Deep Dive’ Dashboards, mostly Dashboard 5A and 5B.

The first image is the total view by Business Models (Peer groups) and is not filtered. Dashboard 5B Licensee Deep Dive

This chart highlights that before any filters are applied, the the Super Fund Business Model scores the highest Star Rating at 3.18 and 22% of the advisers are ‘5 Star Advisers’. Financial Planning at 3.10 with 1,035 5 Star Advisers or 9%. Accounting - Limited Advice has the lowest score driven by so many advisers with less than 10 years experience, with many joining from 2016 onwards via a restricted SMSF AFSL.

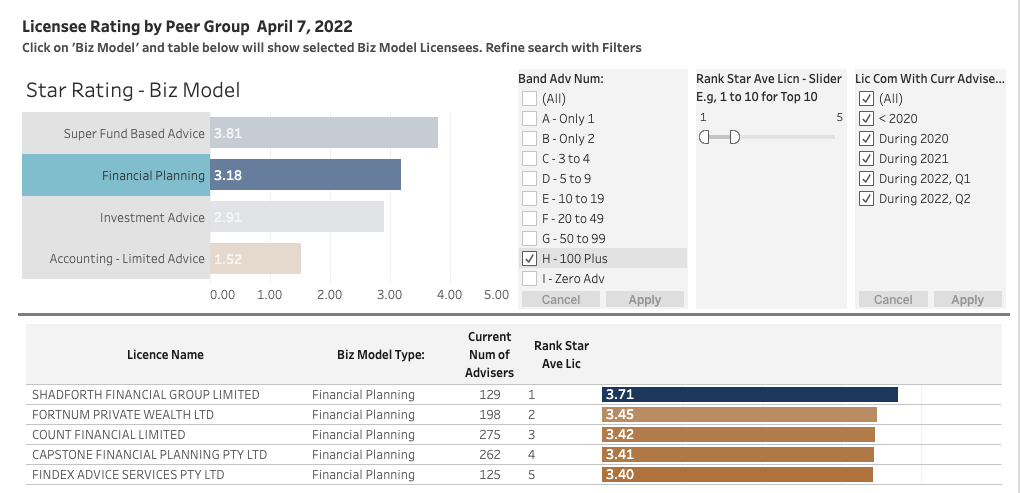

The following chart focus mainly on the Financial Planing business model. The first chart highlights the a score of 3.18 for the licensees that have 100 or more advisers. This is higher than the overall score of 3.10 when it was unfiltered above. We also show the top 5 ranked licensees Dashboard 5A Licensee Deep Dive

Top 5 licensees for Financial Planning model with 100 or more advisers. The top 5 shown are long standing licensees with a good mix of experience with scores above the benchmark for this grouping at 3.18. Note: We do have a breakdown at Dashboard 4, showing how they all ranked in key measures such as experience and qualifications. The lowest 3 scores (not shown) were 2.28, 2.89 and 2.99

This chart above from Dashboard 5B Licensee Deep Dive simply shows the breakdown of the percentage of advisers per Star Rating - Shadforths, has the most 5 Star Advisers. By viewing Dashboard 4 (Not shown here), we do see that average years experience at Shadforths is below 3 of the other 4 licensees. Where Shadforths performs well is with higher qualification rates and memberships of advice associations.

The following chart shows licensees with between 20 and 99 advisers. The score has now dropped significantly down to 2.94. We have ranked the top 5 and only one licensee, Lonsdale, had more than 50 advisers. The top for 5 have scores greater than licensees ranked 2-5 for 100 plus advisers. The lowest scores included two licensees with an average of less than 2 at 1.89 and 1.95 and the 3rd lowest was 2.07. The variance in this grouping is more significant than that for licensees with 100 or more.

The next chart below is for all licensees with less than 5 advisers (most common sized self-licensed AFSL) who have commenced since 2020. The overall score is 3.35 for the Financial Planning Business Model, the highest of all the various categories shown above. This indicates that the majority of financial planners setting up their own AFSL combine a strong level of experience and qualifications. Worth noting that the Accounting - Financial Planning (Advisers linked to accounting groups and providing holistic advice) scored very well in this scenario at 3.39.

How to use this data?

This data can and is used differently by our clients. Below we highlight some example by business type. It should be stressed that the Star ratings is a starting point of your research. We have all the key data points by each licensee that have contributed to the scores.

1 - You are a senior leader at a licensee with a goal to grow adviser numbers.

Know your strengths and weaknesses - The data gives you a high-level starting position of your licensee versus your peers in terms of measuring experience and qualifications. You can also refine this by selecting licensees that are often seen as a direct competitor. Along with Dashboard 4 - Deep Dive Licensee Table and Dashboard 3 Deep Dive Licensee Charts, you can create a better understanding of your core strengths and weaknesses and how this may be perceived by advisers looking to change licensees.

For example, you might have a low score driven by a higher number of new advisers at your licensee which could be seen as a strength not a weakness. This will allow you to focus on what’s important for your licensee and how to better pitch the advantages of your licensee versus competitors.

Search for Advisers - You may have a practice that is looking for an experienced and qualified adviser in their locality. You can do an adviser search on our Adviser Database by a Post Code range and also filter by advisers who have been awarded 4 or 5 stars. This would generate a list of advisers for you to investigate further..

2 - Your are a financial adviser and own your own practice - You are considering a new licensee or commencing your own AFSL

The Star Rating gives you an opportunity to quickly review licensees in different segments. For example, you can review large and mid tier licensees very quickly. Other tools such as our Licensee Database Search give you the option to delve deeper into each licensee right down to the current and ceased advisers. This will help you build a picture of the licensees that could be a good fit for your practice.

You may also opt to review new AFSLs and find advisers linked to those who have a similar background to yourself. Our database allows you to search such licensees and ‘click’ through to adviser data and licensee websites for a comprehensive look at the business and make contact with them.

3 - You offer Investment funds or other services to advisers and your target market are small licensees

With over 1,900 licensees with less than 20 advisers, you need to sharpen your focus. The rating system quickly points you in the right direction. For example, a higher rating will mean the advisers have a good combination of experience and qualifications. This can imply that the licensee has the makings of a strong business and ideal for your services.

Our tools can refine the search by what the licensees are authorised to offer / not offer. We can also break them down to states and post codes with a ‘link’ to their websites.

*Data collected from the ASIC Financial Adviser Register - Click To Access The Register - If you feel that you or your licensee is not represented correctly in our reporting, please call or email to discuss.

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950