Weekly Financial Adviser Movement To July 8, 2021

This week’s analysis of the ASIC Financial Adviser Register (FAR), shows an increase of 23 Adviser Roles moving from a total of 19,345 to 19,368.

The number of actual Advisers increased by 22 from 19,082 to 19,104

Click Here To Access The Detailed Adviser Dashboards

(See Dashboard 17 for more information to the variation between Adviser Roles and Actual Advisers)

A New Financial Year Bounce

This week sees a bounce +22 actual Advisers in terms of net growth after last week’s fallout of losing 549 Advisers. Most of the bounce can be attributed to new small (self-licensed) firms appearing for the first time. In total, 9 new licensees for a total of 15 Advisers. A net growth of 6 Provisional Advisers also assisted the bounce. There was a bit of shuffling at some licensees which we will touch on later.

There could be some further re-work of the financial year data next week, remembering that licensees have 30 days to report movement. However, this week’s data suggest the vast majority of data surrounding the financial year is now in. To better understand the movement of the last few weeks, we have now placed ‘Most Growth’ and ‘Least Growth’ charts for the last 4 weeks of data on Dashboards 1A and 1B.

For those who like the detail - The net growth for July is currently +70 (See Dashboard 7), (-722) for May and (-470) for June. It does get a bit tricky to represent the data with licensees given 30 days to report and ASIC release the data weekly. For our weekly data, we take a ‘snap shot’ of last week and compare to the this week against current Adviser roles. For the remaining data points, we use actual dates of when Advisers were appointed / resigned as listed on the FAR. What is happening right now, is that most of the resignations being reported are for June and appointments are in July.

Key Movements This Week:

94 Appointments, (-71) Resignations - Net Change in roles of +23

7 Provisional Advisers Appointed (new Advisers) and (-1) Resigned - Net Change of +6 (Provisional Advisers included in above figures)

56 Licensees had net growth for the week for a total of 94 Roles. This includes 9 new licensees for a total of 15 roles

43 Licensees had net losses of (-71) roles.

Growth This Week

WT Financial Group (Combined Wealth Today and Sentry as per proposed deal) had greatest growth for the week of 8. Much of this was to do with shuffling Advisers off one licensee to another over the financial year. Looking at the Rolling 4 Week Chart for WT Financial Group, they have a net loss of (-8) roles.

Capstone Financial had growth of 5 and over the 4 week period they are at (-8). Baker Young Limited (Investment Advice / Stockbroking) had growth of 5 and also plus 5 for the last 4 weeks. Their new Advisers came from Morgans.

Losses This Week

AMP Group down (-7), losing (-4) from AMP Financial Planning, (-2) from Charter and (-1) from Hillross. Canaccord lost (-6) and Guests Superannuation Services (-5) and effectively closed as now down to Zero roles. Guests is an Accounting Group and I believe they have no direct connection with major super funds.

At total of 9 Licensees did close for (-16) Roles. This includes Wealthsure (-1) connected to WT Financial Group, RV Group (-4) owned by Fitzpatricks. Most of the closed licensees are associated to firms that are not providing holistic advice.

Year To Date Data

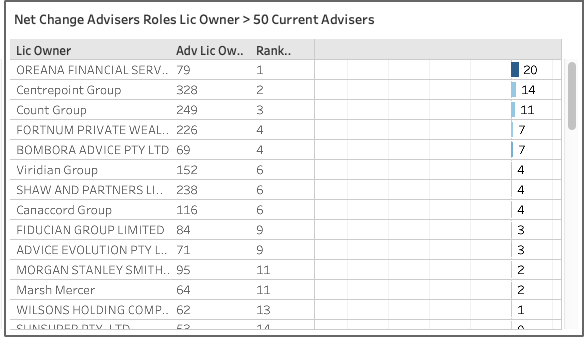

The movement over recent weeks clearly demonstrates how hard it is to grow in the current environment. Only 13 Licensee Owners (with more than 50 Adviser roles) have made gains for a total of 82 roles. Oreana at the top with 20, followed by Centrepoint at 13 and Count at 11.

At the other end of the table, 39 Licensee Owners are in the red for a total of (-1,467) roles. Four Licensee Owners had losses of more than 100, IOOF at (-377), AMP Group (-231) and NTAA (SMSF Advisers) at (-162) and Easton Group (-112).

At the Peer Group Level (see dashboard 3). Financial Planning (firms that provide mostly holistic advice) are down (-900) or (-6.97%). Accounting - Limited Advice (firms providing mostly restricted SMSF advice) down (-416) roles or (-20.80%).

FASEA Exam News

A busy few weeks at FASEA by announcing extension of time to complete the exam for some Advisers and the results of the May Exam was published this week. And just now, July 8, 2021, (after I originally wrote this post - Thanks FASEA!), disclosing that ALL advisers can resit the November exam without waiting for three months between exams.

I’m guessing the data of losing 549 Advisers last week and media coverage it got may have prompted FASEA to take some action. I also think that FASEA (and others) have failed to correlate pass rates with Advisers who are current on the FAR. There seems to be a general assumption that Advisers passing the Exam are all current, but this is not the case. (see below as an example over the last four weeks).

Will need some time to digest all of this news as to how it would effect how the number of Advisers post the initial need to pass the exam of Jan 1, 2022. I did initially write that the first extension of time would not make a big difference to our estimate that the number of Advisers would reduce to 15,000. It may however push out the date to get down to 15,000.

The Investment Advice peer group (Firms that provide mostly portfolio advice) may benefit the most from the extension, and now benefit from the November exam for all. Anecdotal evidence via different discussions, mainstream and social media, indicates that this group is struggling a bit more than most with the exam. Being investment specialists, they need more time to get to grips with the ‘holistic advice’ nature of the exam.

FASEA posted that the pass rate for the May exam was 69%, this was in line with our model which we had plugged in a 70% pass rate.

As more data is released, we will update our data and prediction for year end.

Passing FASEA Exam but Not Current on the FAR

Over the last 4 weeks, 953 roles have resigned affecting a total of 943 Advisers. 716 are NOT Current of FAR. From our data, we know that 141 or 20% of the Advisers had passed the FASEA Exam. If we ‘gross up’ the number to account for the Advisers who passed but not publicly disclosed the passed result, we estimate it will be approx 200 or 28%.

Of those that managed to switch / find another role, a total of 227 advisers. We know that 131 had passed the FASEA Exam or 58%. If we gross up for those that have not disclosed their pass result, we estimate the number would be approx 190 or 84%.