Weekly Financial Adviser Movement November 4, 2021

Number of Advisers decreased by (-59) from 18,823 to 18,764

Click Here To Access The Detailed Adviser Dashboards

New Dashboards

We will no longer be providing detailed information of small licensees every week for free on the dashboards. We have all the details and happy to share privately - See bottom of this post for our new online databases.

Key Movements This Week:

Net Change of advisers (-59)

35 Licensee Owners had net gains for 42 advisers

35 Licensee Owners had net losses for (-102) advisers

37 Individual Licensees had net gains of 44

41 Individual Licensees had net losses of (-103)

6 Provisional Advisers (PAs) appointed. This indicates that (-65) experienced advisers dropped off the FAR this week.

Note: On dashboards 1A and 1B, you can ‘hover’ your cursor over each ‘bar’ in the charts and see more details.

Growth This Week

Dashboard 1B - Licensee Owners. Limited growth this week as one would expect after seeing a net loss of (-59). 7 Licensee owners had a net growth of 2 each including SunSuper and QSuper. Lionsgate also gained two which appear as ‘re-appointments’ after the same advisers dropped off the FAR in September. One new licensee commenced with 2 advisers.

28 Licensee owners had net gains of 1 each. This list includes Sambe Investments who now have 17 advisers, Count Group who lost 2 but gained 3. IOOF also in the green after a series of heavy losses.

4 new licensees commenced for a total of 5 advisers.

Of the 35 licensee owners showing growth this week, 25 have less than 20 advisers.

Losses This Week

AMP Group are at the top of the list with (-12), CBA Group at (-10) with (-9) at Commonwealth Financial Planning (CFP) which is soon to be closed. They currently have 173 advisers after this week’s losses.

Centrepoint and Findex both down by (-8) and Business & Taxation Concepts effective closed to advice as they went to zero after all 7 advisers dropped off the ASIC FAR. Craigs Investment Partners a NZ based firm down (-5) as were Euroz Group.

2 licensees ceased for 11 advisers.

Of the 35 Licensee owners that had losses, 10 had 20 or less advisers.

Year To Date Data

Dashboard 2 - Viewing net change by Licensee Owners with 50 or more Advisers, Oreana have extended their lead while remaining at a plus 37 advisers due to the losses this week at Centrepoint. In second position, Count replace Centrepoint with a growth of 7, Bombora and Canaccord are both at plus 6. Centrepoint are now showing growth of 2 advisers.

SMSF Advisers network move back into top spot as the largest single licensee with 640 advisers as AMP Financial Planning slip back to second spot with 635 advisers.

As for losses, very little changed as the large groups continue to dominate the losses. 5 groups, Synchron, Easton, NTAA, AMP and IOOF have lost more than 100 advisers each and all five groups have more than 400 advisers each.

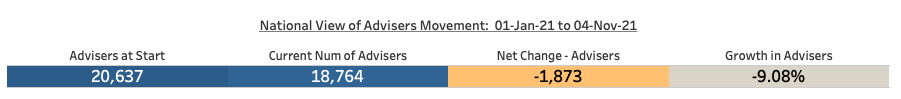

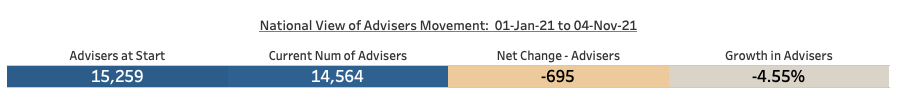

To put the losses at the 5 groups into context, the losses in percentage terms range from (-18.25%) at Easton to (-25.3%) at IOOF with an average of (-21.91%), see Table 3 below. For all adviser groups over the same period the losses are (-9.08%), see table 1. If we remove the bottom five from the results, the net loss of all advisers would be (-4.55%), see table 2.

It should be noted that some of the groups listed had stated their plans to reduce their adviser numbers. Additionally, there have been some cases whereby practices have left a licensee to commence their own AFSL and now use support services from their old licensee.

1 - YTD Movement Of All Advisers

2 - YTD Movement Advisers

Excluding licensees at IOOF, AMP, NTAA, Easton and Synchron.

3 - YTD Adviser Movement

Licensees at IOOF, AMP, NTAA, Easton and Synchron.

*Tally of numbers do not align 100% as a very small number of advisers worked across more than 1 licensee.

News at Wealth Data - Access The Data and Contacts You Need

We have commenced rolling out our databases online in a format that makes finding critical licensee and advisers details super-fast and super convenient - right down to accessing data on your mobile. Elements of the database includes key contact details such as phone and emails, web addresses and much more.

We are in a ‘soft launch’ phase and welcome the opportunity to give you a demo of our current products. We can tailor the final version to suit your business needs. The demo is usually via zoom - Simply call or email to book yours in - will take 30 mins. Our core product is our AFSL Listing with an emphasis on the small licensees who in effect operate as a stand-alone practice. We are also expanding our Licensee listings which provide details by practice and by advisers

Have a great week - any questions, please call or email using the contact details