Weekly Financial Adviser Movement, Oct 20, 2022

Number of Advisers decreased by (-1) from 15,917 to 15,916

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

We have introduced new dashboards along with Adviser and AFSL Databases that are available at our Members Lounge - Click Here For Membership Information

Key Adviser Movements This Week:

Net Change of advisers (-1)

27 Licensee Owners had net gains for 34 advisers

25 Licensee Owners had net losses for (-33) advisers

2 new licensees commenced and (-1) ceased

8 Provisional Advisers (PA) commenced and (-1) ceased.

Summary

This week’s small loss of just one adviser indicates that the adviser market has stabilised after the numbers fell dramatically at the start of the month, due to advisers being removed for not passing the Financial (FASEA) Exam. The growth in Provisional Advisers is still going well and quite broad across the advice sector, which is a sign that advice firms are more comfortable taking on new advisers.

Growth This Week

A total of 27 licensee owners notched up net growth this week. Insignia up net 3, hiring 4 and losing 1. Two hires being Provisional Advisers, one at Consultum and the other at Shadforth. RI Advice picked up 2 advisers including one from Crown Wealth and lost 1 adviser. Boston Reed also up by 3, including 1 Provisional Adviser and an adviser who was re-hired (admin issues?).

Oreana up plus 2 with both advisers switching across from MCA Financial Planners. Oreana are now close to triple figures up to 97 advisers. MCA slip to 20 advisers. NTAA via SMSF Advisers Network up by 2 as are Bluewater Financial Advisers who had advisers switching across from Axies, part of the Spark Financial Group.

22 Licensee owners had growth of plus 1 including Macquarie Group, Bell Financial, Morgans and both new licensees.

Losses This Week

UniSuper are down by (-4) advisers and none have at this stage been appointed elsewhere. Perpetual down by (-3) and to date, not reappointed elsewhere. Three licensee owners down (-2) including AAN Wealth Management, MCA and Crown Wealth. 20 licensee owners down (-1) including AMP Group, Centrepoint, Sequoia, and WT Financial Group. The one licensee that closed lost 1 adviser.

Beware of Tracking Just Licensees

Regular readers would know that we focus high level numbers on Licensee Owners. Individual licensees can look as if they are growing / shrinking quickly due to internal movements at the Licensee Owner level. A good example over the last few weeks has been the growth of Matrix Planning Solutions who are up 6 this week and up by 15 since the start of the Financial Year. However, most of these advisers are being switched across from Clearview.

Since July 1, 2022, Matrix have made 30 appointment and 23 have been switched from Clearview. - See Dashboard 4 of the Adviser Fast Facts series of dashboards. This dashboard has been updated to also show the actual advisers that moved from licensees.

Calendar YTD Movement - Dashboard 2A - Adviser Fast Facts

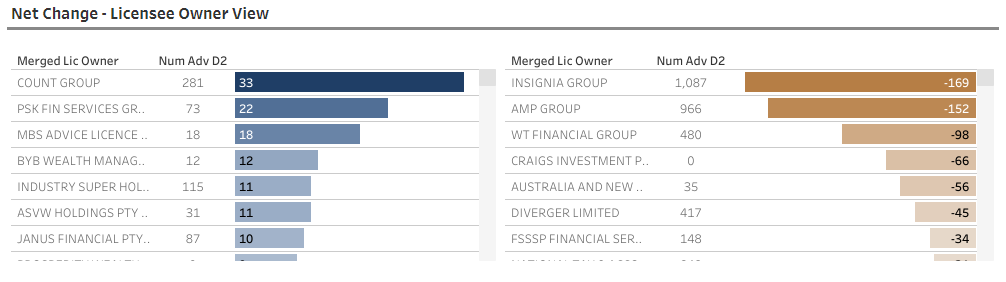

The movement of advisers YTD shows that count Group are still running strong at Plus 33, followed by PSK at 22. Third and fourth spots are both newcomers in MBS and BYB. ASVW Holdings, also quite new comes in at 11 alongside Industry Fund Holdings. One to watch is Janus Financial, the merged entity of Akambo and First Financial, ticking along at plus 10.

Losses are still dominated by the large groups with Insignia at (-169), AMP close behind at (-152) and gap to WT Financial Group at (-98). However, in percentage terms, WT Financial Group are down by 16.96%, which is greater than both Insignia at (-13.46%) and AMP at (-13.60%). See dashboard 3 for percentage movement.

Movement of Advisers by Licensee Owners - Jan 1 to Oct 20, 0222.

T

Members get get all this information plus see movement of advisers into individual licensees at the dashboards - Join Today

Have a great week and checkout the

Members Lounge for all of your data needs - Click on box below