Experienced Pathway - Analysis of ASIC ‘Live’ Data

Note - Tables and data modified and updated September 18 - 2025

ASIC recently announced a ‘live’ Financial Adviser Register (FAR), albeit dated July 25, 2025. It was highlighted in an ASIC Financial Advice Update for August dated August 8. It released the FAR dataset and updated it on August 15 which included the following key data points, for each current adviser in relation to the Experienced Pathway.

Notification from each licensee that their adviser (relevant provider), is relying on the Experienced Pathway - answered Yes, No or blank (no communication)

The date the adviser passed the Financial Adviser Exam

Qualifications marked as going towards the qualification standard required by Jan 1, 2026.

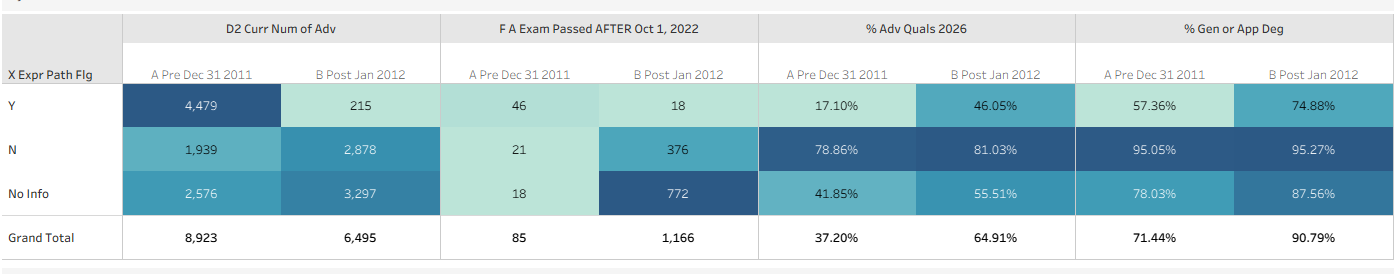

We have analysed the data against today’s ASIC Financial adviser Register. Below is a chart we have created. Note: Total Advisers covered is 15,418

Current Position of Adviser notifying ASIC of intentions to use the Experienced Pathway

Key data points explained:

As of August September 18, 2025, there are 15,418 advisers in total.

They are grouped by when they first became advisers, based on ASIC FAR:

Before December 31, 2011

After January 1, 2012

To qualify for the Experienced Pathway (EP), advisers must have started before Dec 31, 2011.

Among those who began by the end of 2011:

4,479 said yes to using EP

1,939 said no

2,576 have not stated their intention

Additionally, 215 advisers who started after 2012 claimed they will use EP, which indicates that ASIC data could be incorrect or advisers have made some errors or a bit of both.

46 advisers said they would use EP but missed the deadline for passing the Financial Adviser Exam of October 2022 in order to qualify for the EP.

Many advisers said no to EP. Reviewing their qualifications against qualifications noted that will count towards 2026 standards:

78.86% of advisers from before 2012 who answered no to EP have qualifications that can be used towards 2026 requirements

95.05% have a degree, though relevance is unclear

Of those (before 2012), who have not communicated (No Info), only 41.85% have a qualification that could count towards 2026 and 78.03% have a degree, again, relevance is unclear.

By business type, very few Accounting - Limited Advice advisers (who offer restricted advice for SMSFs) have shown interest in continuing into 2026.

In summary, the data is incomplete. ASIC stresses the need for licensees to update advisers details to ensure only qualified advisers can keep working from January 1, 2026. We will provide updates as more information comes in.