Financial Adviser Insights, Aug 31, 2023

Adviser Numbers This Week, Net Change of (-12) Moving Down 15,712 to 15,700

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

Join our Members Lounge - Click Here For Membership Information -

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements This Week:

Net Change of advisers (-12)

Current number of advisers at 15,700

Net Change of (-99) for Calendar YTD

Net Change new Financial YTD +134

22 Licensee Owners had net gains for 26 advisers

24 Licensee Owners had net losses for (-37) advisers

1 New licensee and 1 ceased (Note: Dashboard now shows New and Ceased licensees)

2 New entrants

Number of advisers active this week, appointed / resigned: 70.

Growth This Week - Licensee Owners

Growth this week was moderate and mostly driven by advisers leaving Nexgen Financial Group, owned by The Financial Link Group.

A new licensee owner commenced this week with two advisers, both moving away from Fitzpatricks

Three licensee owners, LFG Financial services, Castleguard Trust (Lifespan) and AD Financial Services, all up by net two advisers, in all cases, the advisers had switched across from Nextgen.

18 Licensee owners were up by net 1 each including, Steinhardt Holdings (Infocus), Morgans, Centrepoint and Insignia who appointed 3 and lost 2 advisers.

Losses This Week - Licensee Owners

Financial Link Group (Nextgen) lost (-10) advisers. Of the 10 that came off the FAR this week, 5 have been appointed elsewhere.

Four licensee owners were down by net (-2) adviser each, including; AMP Group who appointed 1 and lost (-2) and Fiducian who hired a new entrant but lost (-3) advisers.

19 licensee owners were down by (-1) each including, Capstone, Diverger, Shartru and WT Financial Group. The lone licensee that ceased also only had the 1 adviser.

Who would be a BDM?

It didn’t seem so long ago that a national business development manager (BDM), of an investment based business, could knock on six doors and have access to some 70% or more of the advisers. The doors would have belonged to the big four banks, AMP and Insignia (IOOF). And that 70% of advisers would have been a lot more than the total current number of advisers.

Today, the landscape has changed dramatically. As the banks pulled out, their licensees have been sold or left to dissolve on their own accord. We have also seen the growth of the ‘Micro AFSLs’. Along the way, we also saw the introduction of the Accounting - Limited Advice AFSL who only offer SMSF administrative advice.

The challenge today for the BDMs is finding the advisers who are authorised to offer investments. Currently, there are 15,700 advisers operating out of 1,844 licensees, but not all can offer investments via a WRAP.

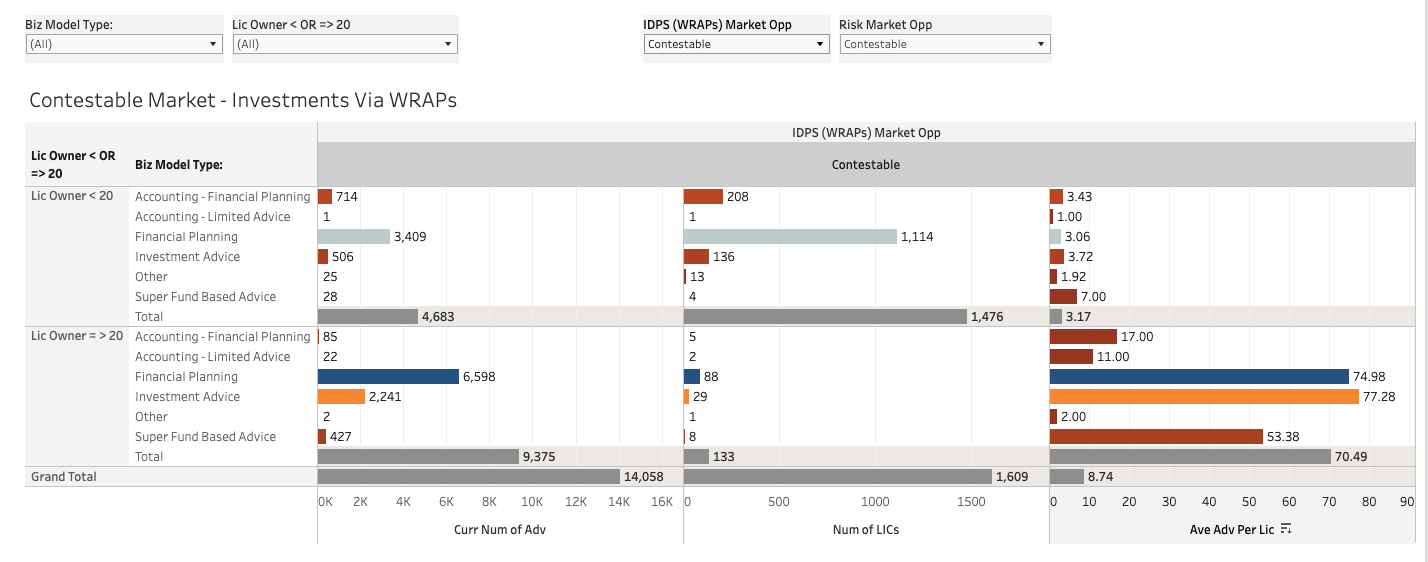

The chart below (Dashboard 9A from Licensee Deep Dive) highlights the ‘Contestable’ adviser market, i.e. the advisers who are authorised to offer such investments to the public. The chart is broken into two key segments, licensees that have below 20 current advisers and those that have 20 or more. It is further broken down by the business models.

Looking at the grand totals, there are 14,058 advisers, spread across 1,609 licensees, at an average of 8.74 advisers per licensee. As for the advisers working in licensees of less than 20 advisers, there are 4,683 advisers working out of 1,476 licensees and an average of 3.17 advisers per licensee.

To make matter more complex for the BDM, the number of new licensees keeps growing, so far this year we have seen 76 new licensees and since 2020, the total is a staggering 491, almost all micro AFSLs.

For any BDM still reading this, we can help! We have a database that can be filtered by licensees that suit your target market, including the new licensees. We also provide key person information and contact details at the license level via our AFSL Blue Book - To know more, visit our Blue Book - AFSL Listing Page

Contestable Adviser Market For Investments via a WRAP Account

Dashboard 9A Licensee Deep Dive

Have a great week and checkout the

Members Lounge for all of your data needs - Click on box below