Financial Adviser Market Insights, February 12, 2026

Adviser Numbers Increased by Eleven for the week moving from 15,130 to 15,141

The net change of financial advisers increased by eleven for the week. A solid week for new entrants at 17.

Three new licensees commenced and four ceased. A total of 82 advisers affected by change.

A jump in disciplinary actions

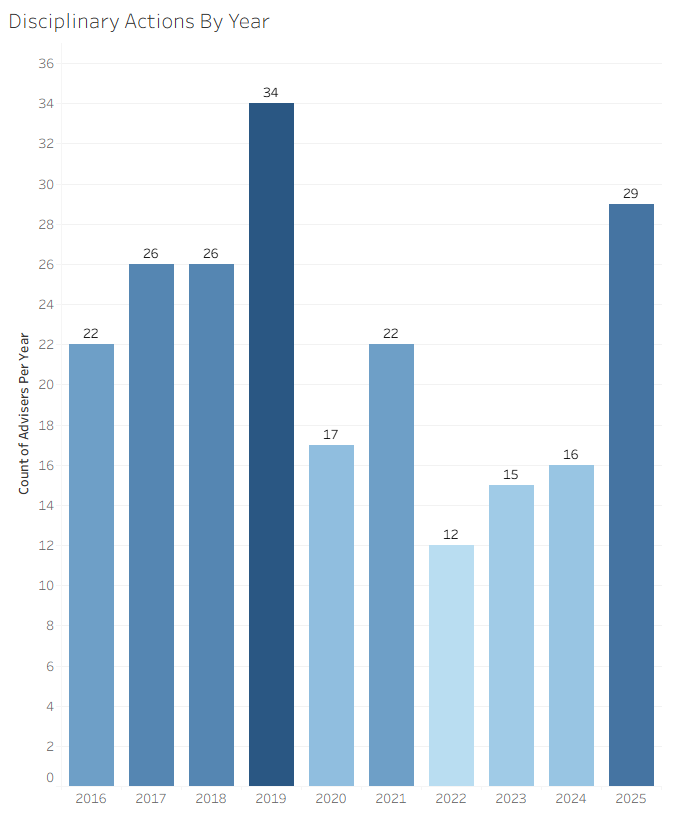

The total number of disciplinary actions brought against advisers jumped to 29 for calendar year 2025, up from 16 in 2024. This was the biggest total since 2019 when it hit 34. However, back in 2019, there were a significant greater number of advisers. More details in the post below.

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements for the week

15,141 current advisers

Net change of advisers +11

26 licensee owners had net gains of 38 advisers

23 licensee owners had net losses of (-28) advisers

3 new licensees and 4 ceased

17 new entrants

82 advisers affected by appointments / resignations.

Other key dates affected by this week’s data

Net Change Calendar 2026 YTD +69

Net Change Financial YTD (2025/26) (-30)

Net change last 12 months (-418).

Growth - Licensee Owners

A new licensee commenced (details given to Members) with five advisers who were all previously at Sira Group, owned by Bannister Consulting (Note: one adviser still listed at Bannister Consulting).

Sensible Investment Management, owners of licensee “Fish Tacos” up by four, all being new entrants

Merchant Wealth Partners up by three, all three previously with Bombora Advice (one still listed as being with Bombora)

Three licensee owners up by two each:

A new licensee both advisers leaving Capstone

Infocus Group, one adviser switching from Fitzpatricks Private Wealth and one new entrant

Christopher Allan (AAG Financial Planning Pty Ltd), with one adviser switching from Fortnum Private owned by Entireti & Akumin Group and one from JFP Advisory

A total of 20 licensee owners up by net one including: WT Financial Group, Ord Minnett Group and the remaining new licensee.

Losses - Licensee Owners

Bannister Consulting (Sira Group), down by four, as mentioned above, the advisers commencing a new licensee

Entireti & Akumin Group down by two

Rhombus also down by two

A tail of 20 licensee owners down by net one each including, AvalonFS, Insignia Group and Oreana. All four licensees that ceased were one adviser firms.

Disciplinary Actions by Year

Disciplinary actions rose to 29 in 2025 from 16 in 2024 — the highest since 2019 (34). Most resulted in adviser bans or disqualifications.

None of the advisers affected in 2025 are listed as “current” on the ASIC Financial Adviser Register (FAR). Over the past ten years, 216 advisers were affected and only 11 are current on the FAR.

Some may think these totals are low because adviser bans often appear in the news. But many high-profile cases involve people not listed on the FAR (for example, Melissa Caddick), and some advisers appear in multiple reports as the same case progresses (identification, banning, sentencing).

. Number of Disciplinary Actions by Year Jumped in 2025