Financial Adviser Market Insights, February 5, 2026

Adviser Numbers Decreased by Eight for the week moving from 15,138 To 15,130

The net change of financial advisers decreased by eight for the week, despite ten new entrants coming onto the ASIC Financial Adviser Register (FAR). The number of new entrants for 2026 is now at 47.

One new licensee this week and three ceased.

The total number of advisers who have ceased since December 1, 2025 to today, increased from 477 to 504.

A total of 89 advisers affected by change this week up on 59 from last week.

Tracking Experienced Pathway and Qualifications - Based on the latest weekly ASIC ‘point-in-time’ data dated January 29, 2026 (designed specifically to track Experienced Pathway and qualifications), and cross referenced with today’s FAR, highlights the following:

120 advisers (was 130 last week) have not flagged as either ‘Yes’ or ‘No’ to the Experienced Pathway (EP), still show as not having qualifications meeting the 2026 standards. Of the 120, 105 are advisers authorised in licensees of less than 10 advisers

66 of the 120 advisers above may be eligible for the EP as they commenced pre Dec 2011

27 advisers have indicated they will not take up the EP but have no qualifications for the 2026 standards, was 28 advisers last week

67 advisers (66 last week) flagged for the EP, took the FASEA exam after October 2022 and are therefore likely to be ineligible for the EP

The data is definitely being cleaned up each week, but a more work needs to be done. We will revisit the data every few weeks as the FAR slowly but surely gets cleaned up.

Members can track this data at a temporary dashboard 7B, of the ‘Licensee Deep Dive’ set of dashboards.

ASX wealth firms and sector performance — 2025 and the past three years

In this post below, we show how ASX-listed wealth firms and related sectors performed in 2025 and over the last three years.

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements for the week

15,130 current advisers

Net change of advisers (-8)

31 licensee owners had net gains of 38 advisers

23 licensee owners had net losses of (-47) advisers

1 new licensees and 3 ceased

10 new entrants

89 advisers affected by appointments / resignations

Other key dates affected by this week’s data

For calendar year 2025, total loss is currently showing (-400)

Net change of (-145) when excluding licensees that provide mostly limited SMSF advice

Net Change Calendar 2026 YTD +57

Net Change Financial YTD (2025/26) (-41)

Net change of +73 when excluding licensees that provide mostly limited SMSF advice.

*Note: Most losses backdated into 2025 and new appointments dated in 2026 hence a positive start to 2026.

Growth - Licensee Owners

Lifespan up by three with all advisers switching from three different licensees, Interprac owned by Sequoia, LFC Group and Hejaz Financial Advisers

Five licensee owners up by two each:

A new licensee (details given to members) with advisers moving from FYG Planners

The Trustee for CCAFP (CCAFP Wealth) with both moving across from Interprac

FSSSP Financial Services (Aware Super), one coming across from Fortnum Private owned by Entireti & Akumin Group and ART Financial Advice (Australian Retirement Trust).

Entireti & Akumin Group, losing one adviser at Hillross and picking up three at Akumin Financial Planning, with one each from Core Value FA and ASVW Financial Services, and one adviser coming back after a break of 2 years.

Advice Evolution with one from Interprac and one coming back into advice after last being on the FAR back in 2019.

A total of 25 licensee owners up by net one including Centrepoint Group, Capstone and Picture Wealth.

Losses - Licensee Owners

Sequoia Group down 10 advisers. This week: 11 left, 1 joined. Since 1 Oct 2025: 55 resignations, 4 hires. Of the 55 who resigned, 40 were reappointed: 14 to Centrepoint Group, 4 to Lifespan, 3 to Advice Evolution, and 14 to various small licensees (each with under 20 advisers).

Telstra Super down by eight - note, due to upcoming merger with Aware Super, Telstra will be using Aware Super AFSL for its advice. None of the eight have been reappointed elsewhere to date.

Bombora Advice down by four, none appointed elsewhere to date

The Trustee for Mancel Family Trust (FYG Planners) down by three, two commencing their own licensee and one joining Apex Macro Financial

Three licensee owners down by net two each:

Hejaz Capital, both not appointed elsewhere

MJC Partners and now down to zero advisers. Neither adviser appointed elsewhere

Wing Plan Pty Ltd and both not appointed elsewhere

A tail of 16 licensee owners down by net one each including, Findex, Shartru and Industry Super Holdings.

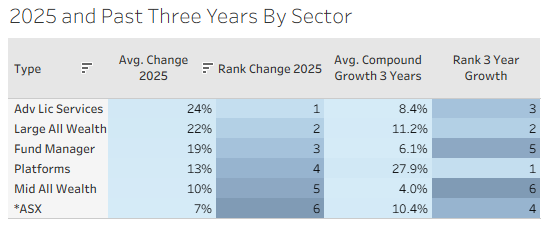

Share Price Change Across Wealth Related Firms and Sectors.

Below are a couple of tables highlighting the change in share price for a number of wealth based firms listed on the ASX. We have also included the ASX 200 and ASX Financials indices for a general comparison.

The first table highlights change by specific groupings. The first is by the average change over 2025 and its rank and then over the last three years and its rank.

All sectors for 2025 out did the average of the two ASX indices. Adviser licensee service based firms did best over 12 month at 24%, whereas over the last three years, Platforms easily had the highest compound return at 27.9%. Note: Returns are based on change in the share price at end of key years and does not include dividends.

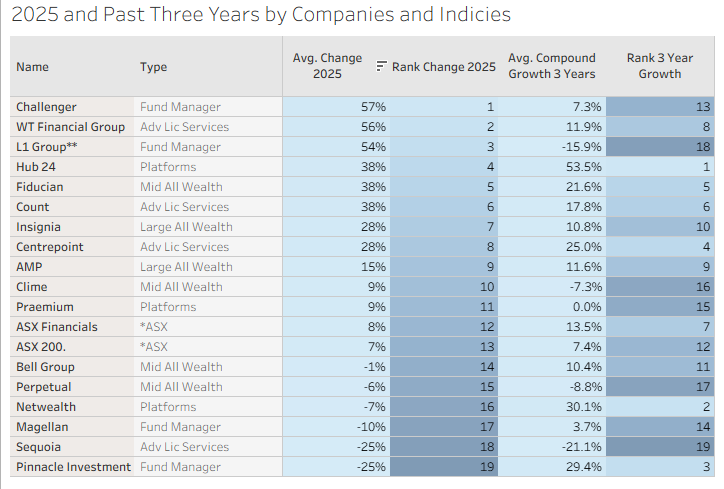

The table lists firms and indices. Challenger had the largest 12-month gain but ranks 13th over three years. WT Financial Group and Count performed well both one- and three-year. Sequoia dragged the sector down. HUB24 had a strong year and was the best three-year performer, returning over 50%.

By firms and indices, highlighting which sector the have been grouped into.

**L1 Group - From a share price perspective was known as Platinum which merged with L1 Capital and renamed L1 Group in August 2025.