Financial Adviser Market Insights, January 22, 2026

Adviser Numbers Decreased By Nine for the week moving From 15,145 To 15,136

The net loss this week is nine advisers, with losses reduced by 11 new entrants coming onto the ASIC Financial Adviser Register (FAR). A total of 32 new entrants have commenced since Jan 1.

No new licensees this week and three ceased.

The total number of advisers who have ceased since Dec 1, 2025 to today, jumped from 440 to 468.

Based on the latest weekly ASIC ‘point-in-time’ data dated January 15, 2026 (designed specifically to track Experienced Pathway and qualifications), and cross referenced with today’s FAR highlights the following:

185 advisers that have not flagged as either ‘Yes’ or ‘No’ to the Experienced Pathway (EP), still show as not having qualifications meeting the 2026 standards

74 of those advisers may be eligible for the EP

36 advisers have indicated they will not take up the EP but have no qualifications

67 advisers flagged for the EP took the FASEA exam after October 2022 and are therefore likely to be ineligible for the EP

Members can track this data at dashboard 7B of the ‘Licensee Deep Dive’ set of dashboards.

It will be interesting to see how the data stacks up when we enter February, by which time all licensees would have needed to fully update their advisers data on the FAR.

Need more date - become a Member at just $39.00 for the first month

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements for the week

15,136 current advisers

Net change of advisers (-9)

29 licensee owners had net gains of 36 advisers

28 licensee owners had net losses of (-45) advisers

Zero new licensees and three ceased

11 new entrants

85 advisers affected by appointments / resignations

Other key dates affected by this week’s data

For calendar year 2025, total loss is currently showing (-387)

Net change of (-135) when excluding licensees that provide mostly limited SMSF advice

Net Change Calendar 2026 YTD +50*

Net Change Financial YTD (2025/26) (-35)

Net change of +77 when excluding licensees that provide mostly limited SMSF advice

*Note: Most losses backdated into 2025 and new appointments dated in 2026 hence a strong start to 2026.

Growth - Licensee Owners

Centrepoint Group up by six, with four switching from Interprac owned by Sequoia, one moving across from Viridian and one new entrant

Rhombus Enterprises up by three, one new entrant, one moving across from Gallagher Benefit Services and one coming back into advice after a short break

A total of 27 licensee owners up by net one including Templestone Financial, Count Limited and Bombora.

Note: Now new licensees this week.

Losses - Licensee Owners

Sequoia down by seven, with two showing as joining Alliance Wealth owned by Centrepoint and one joining Havana Financial Services. The remaining four not showing as being appointed elsewhere to date

NTAA (SMSF Adviser Network) down by five with six ceasing and not appointed elsewhere and one re-joining after ceasing in mid December and re-joining in mid January 2026

Hejaz Capital down by three with one joining Advocate Advisory, another joining Alethia Partners and the remaining adviser yet to be appointed elsewhere

The Parity Group also down by three and moving to zero advisers, one adviser joining Connectus AFSL Ltd and the other two advisers yet to be appointed elsewhere

Three groups down by two each:

Lifespan, one joining Avana Financial services and the other not appointed elsewhere

Now Financial Group, down to zero advisers, with neither showing as appointed elsewhere

Strategic Finance Partners, both not appointed elsewhere

And 21 licensee owners down by one each including Entireti & Akumin Group, Industry Super Holdings and NAB Bank.

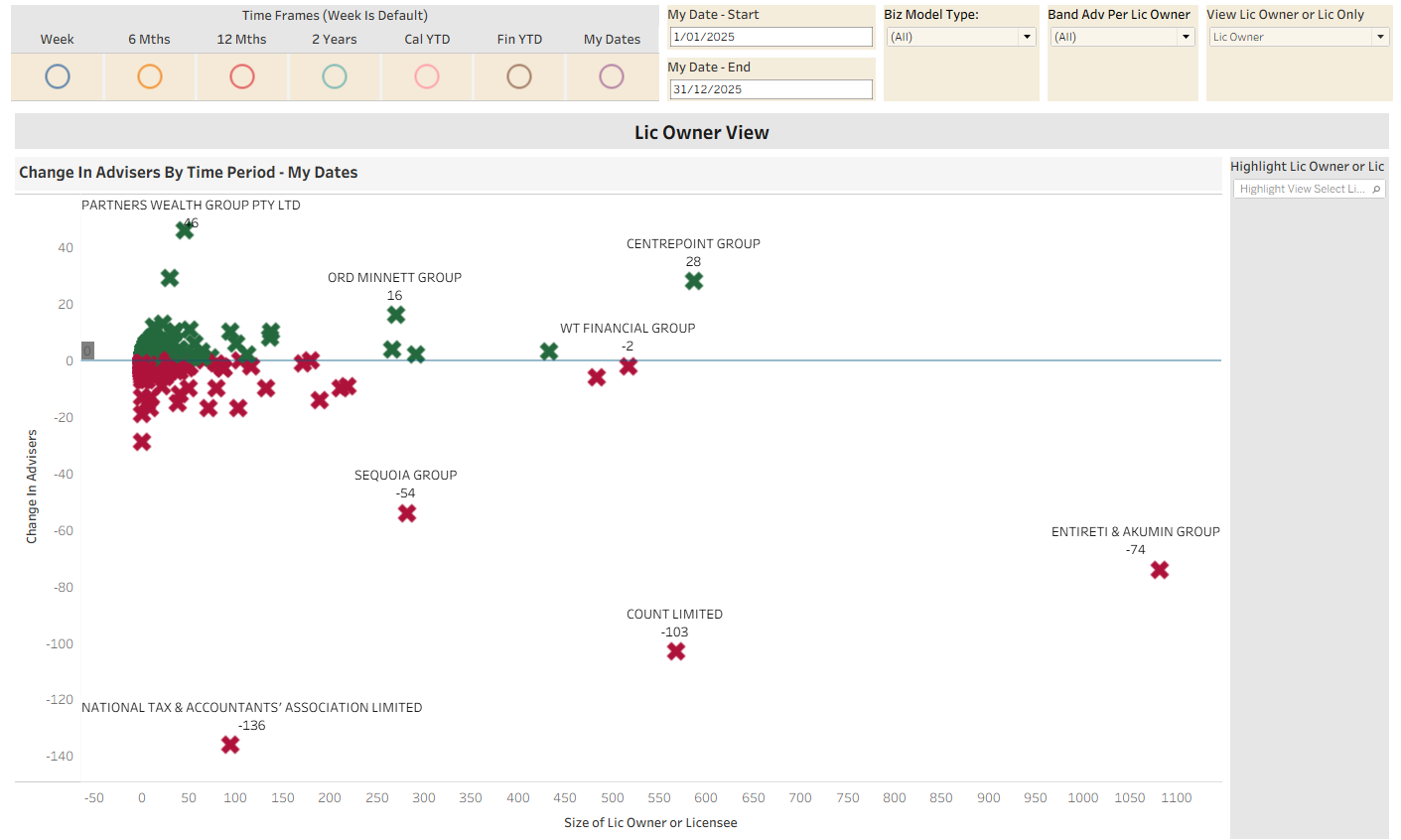

2025 - Quick Overview of Net Movement by Licensee Owner

The chart below highlights the net movement of advisers by licensee owner. The bottom horizontal axis is based on the current number of advisers at each licensee owner and the vertical axis is the adviser movement.

The data highlights that large licensee owners have become ‘outliers’ with the vast majority of groups now having less than 100 advisers.

Greatest growth is a new licensee, Partners Wealth Group with net growth of 46. Centrepoint Group showing up well for a large group at 28 (and off to a good start in 2026).

National Tax and Accountants Assoc (SMSF Adviser Network), with the largest loss of (136). This firm specialises in restricted licensing to accountants to offer SMSF based advice only. Count Limited at (-103), they have also been affected by restricted SMSF licensee services. Entireti & Akumin Group, easily the largest group and suffered a net loss of (-74), much of which was due to Partners Wealth Group exiting their group.

A full round up will be prepared post the Australia Day weekend

Screenshot of dashboard 2 of Adviser Fast Facts - for 2025 calendar year