Weekly Financial Adviser Movement, August 25, 2022

Number of Advisers decreased by (-38) from 16,394 to 16,356

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

We have introduced new dashboards along with Adviser and AFSL Databases that are available to Wealth Data Members - Click Here For Membership Information

Key Adviser Movements This Week:

Net Change of advisers (-38)

23 Licensee Owners had net gains for 32 advisers

44 Licensee Owners had net losses for (-72) advisers

3 new licensees commenced and (-10) ceased

3 Provisional Advisers (PA) commenced and (-1) ceased.

Note: Our Members Lounge - Covers all movement and very detailed reports for all licensees and advisers.

Summary

A sharp decline this week with a net loss of (-38) advisers. We may see a small bounce next week, as some of those who have left would appear to be on track to reappear at new licensees in the coming week or so.

Given the announcement this week of the Treasury Consultation Paper ‘Financial Adviser Education Standards’ which creates a new path for experienced advisers, we take a closer look at the difference in advisers who commenced before and after Jan 1, 2009.

Growth This Week

A new licensee commenced this week (details provided to members) with a total of 7 advisers, with advisers moving away from Bombora. AMP Group finally got some growth, up by 3 and all appointed at AMP Financial Planning. Sam Rutecki (AWFP Group) up by 2 advisers. 20 licensee owners up net 1 including Sequoia, Count Group, Industry Super Holdings and Advice Evolution.

The three new licensees accounted for 9 advisers.

Losses This week

Bombora down (-17) which included the 7 to the new licensee mentioned above. Bombora did appoint 2 advisers and lost 19 and 11 of the 19 have yet to appear at a new licensee. Diverger down (-5), losing 3 from Merit and 2 from GPS - Only one has been reappointed at another licensee.

PMM Group (Badge Financial) down by (-3) advisers, as were United Super. 5 licensee owners down (-2) including Castleguard Trust (Lifespan) and Insignia. A long tail of 36 licensee owners down net (-1). We did see two adviser losses backdated into 2021, indicating that ASIC continue to search for advisers on the FAR who should not be there.

Of the ten licensees that closed, 9 were ‘single adviser models and the other only had 2 advisers. 8 of the licensees sit in our Accounting - Limited Advice model (SMSF Advice) and the other 2 in our Accounting - Financial Planning (owned by accountants and provide holistic advice).

Gains and Losses Last Six Months (Dashboard 2B Multi Date)

This week we look back over the last 6 months. Count lead with growth of 14 followed by Sequoia with 12. BYB Wealth (New) up by 11 and AAN Wealth Management up by 10 and have been building steadily with net growth of 22 over 2 years.

As for declines, Insignia down (-108) followed by AMP at (-92). ANZ down (-53). Diverger and WT Financial both down by (-35).

Advisers Who commenced Pre and Post Jan 1 2009. See Deep Dive - Dashboard 4B For Details

The Treasury Consultation paper effectively provides a guide to help experienced advisers to continue practicing without having to gain additional qualifications. Paper can be accessed at The Treasury Website . The information below aims to provide some details to the number of advisers who may well benefit from the proposal.

The paper states that each adviser must have at least ten years experience up to Jan 1, 2019 - It does not need to be continuous. For simplicity, we focus on advisers who commenced pre Jan 1, 2009.

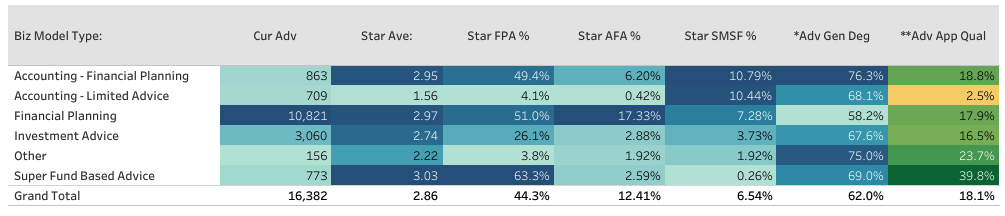

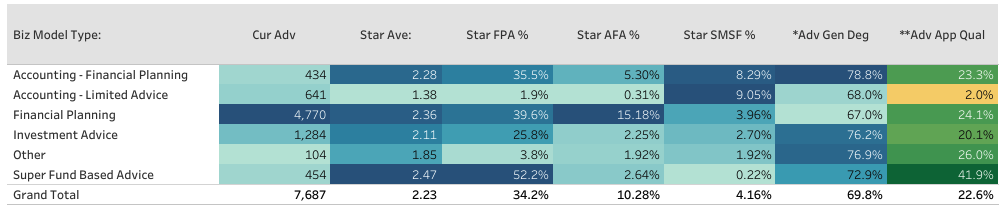

Notes Re Qualifications: *Adv Gen Degree = Advisers who have shown to have a degree of some type under ‘Qualifications and Training’. **Adv App Deg = Advisers who have an AQF qualification classed as Approved Qualifications, previously known as FASEA Approved. Does not include The FASEA Exam.

Re Tables below - The dashboard also shows the same data by all licensees (not shown here)

Table 1 - Highlights that across all advisers 62% of advisers have a degree and 18.1% have an AQF qualification.

Table 2 - Advisers who commenced pre Jan 1 2009, the rates fall to 55.1% and 14.1%

Table 3 - Advisers who commenced post Jan 1, 2009, the rates jump to 69.8% and 22.6%.

These figures are probably no too surprising for most, as it is generally accepted that newer advisers tend to be younger and far more likely to have a degree. It can be seen that advisers linked to accounting based licensees score at higher rates.

The sector that will gain the most from what was proposed in the paper, will be the largest sector - Financial Planning. This model covers financial advisers belonging to licensees who predominately provide holistic advice. In this sector, of pre 2009, just over half of the advisers have a degree at 51.2%. On the assumption that most who have a degree, would be most likely to go on and gain the required ‘Approved Degree’, the proposal does give a huge helping hand to the remaining 48.8% or 2,952 advisers in this sector.

Table 1 - All Financial Advisers Aug 25, 2022

There are quite a few other factors that need to be considered in terms of how many advisers will benefit from the proposal, including the need to pass the Financial (FASEA) Exam. We are expecting the total adviser numbers to dip below 16,000 once we get past Sep 30, 2022, the deadline for many advisers to pass this exam. The proposal is for those who have a minimum of 10 years service by Jan 1, 2019, not all advisers who started pre 2009 would have that, i.e. moved in and out of being an adviser. Lastly, the date for the approved degree requirements is Jan 1, 2026. It is very likely that many advisers who commenced pre Jan 1, 2009 will retire by that date.

As a side note, the Associations may well benefit the most from the proposal. Table 2 highlights that the advisers pre Jan 1, 2009 have an FPA rate of 60.00% in the Financial Planning model and its 19.02% for the AFA. However, for the advisers post Jan 1, 2009, the FPA rate drops to 39.6%% and AFA drops to 15.18%.

Have a great week and checkout the

Members Lounge - Click on box below