Weekly Financial Adviser Movement, Sep 1, 2022

Number of Advisers decreased by (-12) from 16,356 to 16,344

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

We have introduced new dashboards along with Adviser and AFSL Databases that are available to Wealth Data Members - Click Here For Membership Information

Key Adviser Movements This Week:

Net Change of advisers (-12)

26 Licensee Owners had net gains for 38 advisers

31 Licensee Owners had net losses for (-46) advisers

3 new licensees commenced and (-9) ceased

4 Provisional Advisers (PA) commenced and zero ceased.

Note: Our Members Lounge - Covers all movement and very detailed reports for all licensees and advisers.

Summary

A decline of (-12) advisers for the week, this was despite a small bounce of advisers reappearing on the FAR after ceasing in last week’s reporting.

Growth This Week

MBS Advice who commenced last week with 7, added another 7 this week to take them up to 14. This licensee are all advisers who were attached to Bombora (showed as losses last week). A new licensee commenced with 3 advisers, this was a former practice attached to Affinia.

A licensee that commenced last week gained 3 (as signalled to our members) with advisers moving across from WT Financial Group (Synchron). A licensee reappeared with two new advisers and Lee Clarke and Co jumped by 2, with both advisers yet to cease with their current licensees, Hillross and Novatax.

A tail of 21 licensee owners gained 1 adviser each including Wilsons, Politis, Morgans, Fortnum and AMP Group.

Losses This Week

Insignia and WT Financial Group both down (-5). Insignia hired 3 and lost 8, none of the 8 have appeared elsewhere. WT Financial down 5 with 4 appointed elsewhere. Tal Dai-Ichi Life (Affinia) down (-4) and 3 reappointed as noted above.

4 licensee owners down by (-2) including Bluewater and Centrepoint, and a tail of 21 licensee owners down (-1) including Unisuper, Australian Unity and Marsh Mercer.

This week, 9 licensees effectively closed. 8 of the licensees belonged to our Accounting - Limited Advice model (SMSF Advice) and the other was Financial Planning. Total loss was (-9) advisers, all licensees being single adviser practices. Some losses back dated to last year and one all the way back to 2017.

The Financial Advisers Exam - July & August Results and Impact on Adviser Numbers

The results of the financial Adviser Exam (often referred to as the FASEA Exam), were released today (Sept 1, 2022), with a pass rate of 52%. This was a very important exam, as it was the last one before the September 30th ‘extension’ deadline that a large number of advisers had qualified for.

The media release highlights that ‘over’ 15,800 advisers on the FAR have now passed the Exam. Currently, our data, is showing that there are a total of 16,344 advisers (we do not show Timeshare and FX Advisers). Therefore, we could see a loss of more than 500 advisers from the FAR as and when licensees start reporting the losses.

The media release does remind licensees of the need to remove advisers from the FAR who have now failed the exam and won’t pass before the deadline of Sept 30. It indicates that this should occur immediately as there are no further exams available to the advisers. Licensees do have 30 days to update the FAR.

We have seen over recent times, a large number of mostly small licensees can be slow and in many cases, very late at reporting adviser losses due to the failure to pass the Financial Exam. The next few weeks of reporting will be interesting to follow.

How Things Have Changed

This week, as a result of the Quality Advice Review, the main talking points have revolved around the impact that the proposals may have across wealth and in particular across financial advice market. Change is something we are all getting used to, but it is still quite a shock to look back and consider just how much change there has been over recent times.

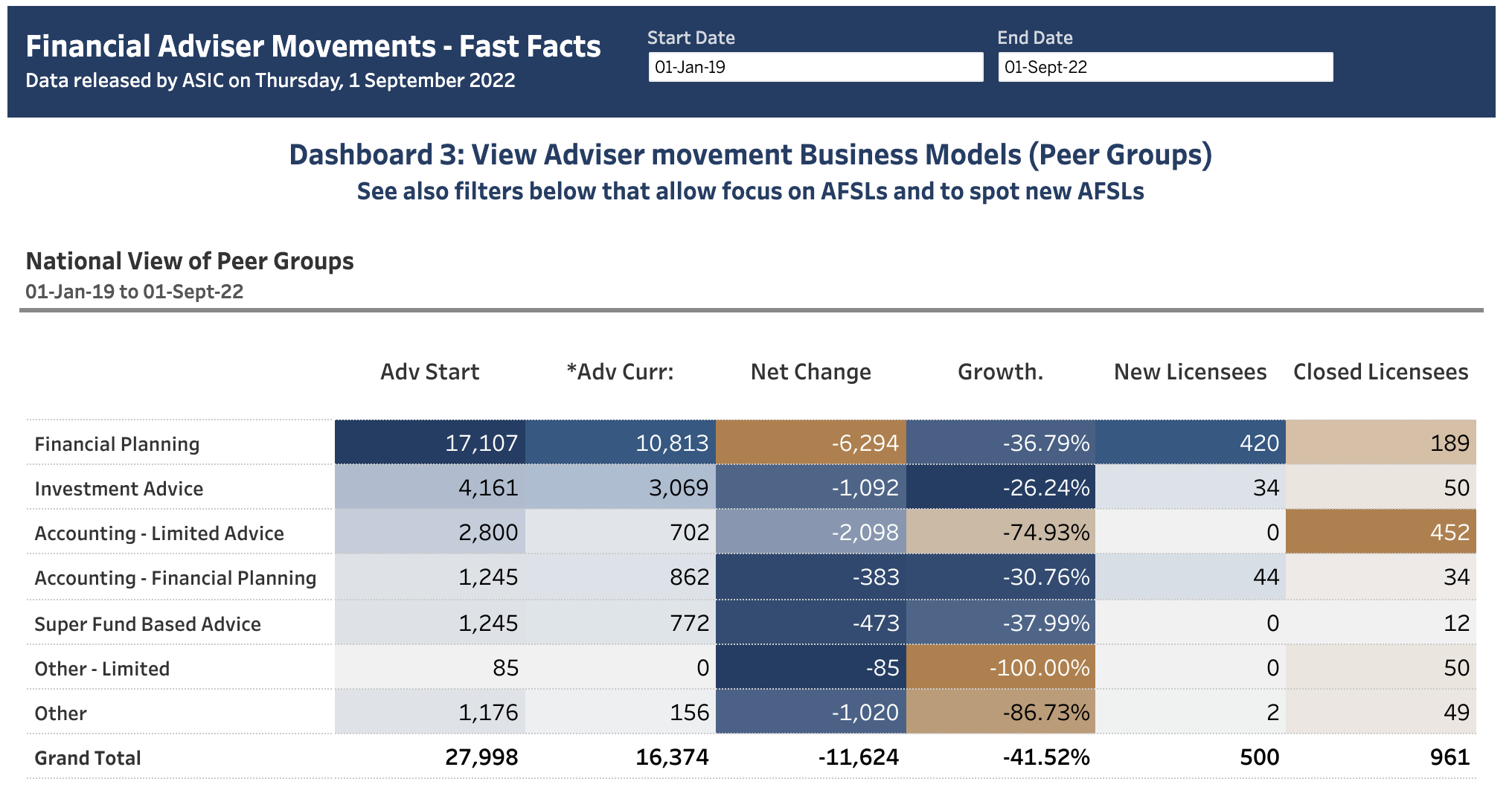

The table below from Adviser Fast Facts - Dashboard 3, highlights the change in adviser numbers across different ‘business models’ that advisers work in since Jan 1, 2019.

Change in adviser numbers since Jan 1, 2019 to sep 1, 2022

Looking at the totals, the adviser market has shrunk by (-11,624) advisers or (-41.52%). The Accounting - Limited Advice (Restricted to mostly SMSF advice), has effectively collapsed to be only a quarter of what it was. We do expect that this sector will also suffer a higher proportion of losses of advisers not passing the Financial Adviser exam, as mentioned earlier in this post.

The number of licensees has also changed substantially, with 500 starting up and close to double closing at 961. However, in the financial planning business model, it is the reverse with 420 starting and less than half as much closing at 189.

In other data (Licensee Deep Dive - Dashboard 6C Licensee History), the number of licensees with 500 or more advisers have dropped from 7 to just 1. The 7 represented 5,453 advisers, the one remaining today has only 551 advisers. Additionally, there was 49 licensees with between 100 and 499 advisers representing 10,401 in total advisers, this is now reduced to 32 licensees representing 6,606 advisers.

Hopefully, after the expected drop off due the the Financial Adviser exam, the numbers may stabilise.

Have a great week and checkout the

Members Lounge - Click on box below