Financial Adviser Market Insights, July 17, 2025

Adviser Numbers Increased By +24 For The Week, Moving From 15,315 To 15,339

Click Here Free Adviser Movement Dashboard

There was a nice bounce back this week with net growth of 24 advisers, bringing to a total of 41 for the past two weeks. For the new financial year it is a positive 155. The reason for the large financial year growth is that the majority of the advisers ceasing are backdated into June 2025.

For the week we saw three new licensees bringing the total to 10 for the new financial year to date. Two ceased in the week. 17 new entrants (new advisers) commenced, and 83 advisers were affected by appointments or resignations.

Need More Data - Sign Up Today For Just $39.00

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements For This Period

Net change of advisers +24

Current number of advisers at 15,339

Net Change Calendar 2025 YTD (-134)

Net Change Financial YTD (2025/26) +155

Net Change Financial Year 2024/25 (-159)

38 Licensee Owners had net gains of 51 advisers

22 Licensee Owners had net losses for (-24) advisers

3 new licensees and 2 ceased

17 new entrants

Number of advisers active in this period, appointed / resigned: 83

Growth - Licensee Owners

A new licensee commenced with four advisers who were previously at Spark Financial Group

WT Financial Group with another good week, up by three including one new entrant and two advisers coming back into advice after a break

Eight license owners up by two:

United Super with both advisers coming back after a break of 12 months

Troy Daniel (Australian National Investment Group), both advisers currently showing as being authorised at Blue Point Consulting

Rhombus with one adviser back after a break of several years and another switching from Horsey Jameson Bird

Rawlings Bolton (Bentleys QLD), both advisers still showing as being authorised at KR Securities

A new licensee with both advisers exiting Hillross owned by Entireti & Akumin Group

Guideway with both advisers being new entrants

Cobalt Advisers with one adviser exiting IPraxis and one from Enva Australia

Bell Financial having a busy week, appointing four advisers, two being new entrants and two coming back into advice after a break, and losing two advisers who are not showing as being appointed elsewhere.

A tail of 28 licensees up by net one including; Williams Buck, Centrepoint and the remaining new licensee.

Losses - Licensee Owners

ASVW Holdings down by net two, not showing as appointed elsewhere to date

Industry Super Holdings also down by two, losing three advisers, none appointed elsewhere to date and gaining one adviser from IMFG Pty Ltd

20 down by net (-1) including FSSSP Financial Services (Aware Super), Oreana and Shaw and Partners.

Snapshot - Financial Year 2024 /2025

The data for the past financial year is still coming in, albeit slowly, noting that licensees have 30 days to report movement.

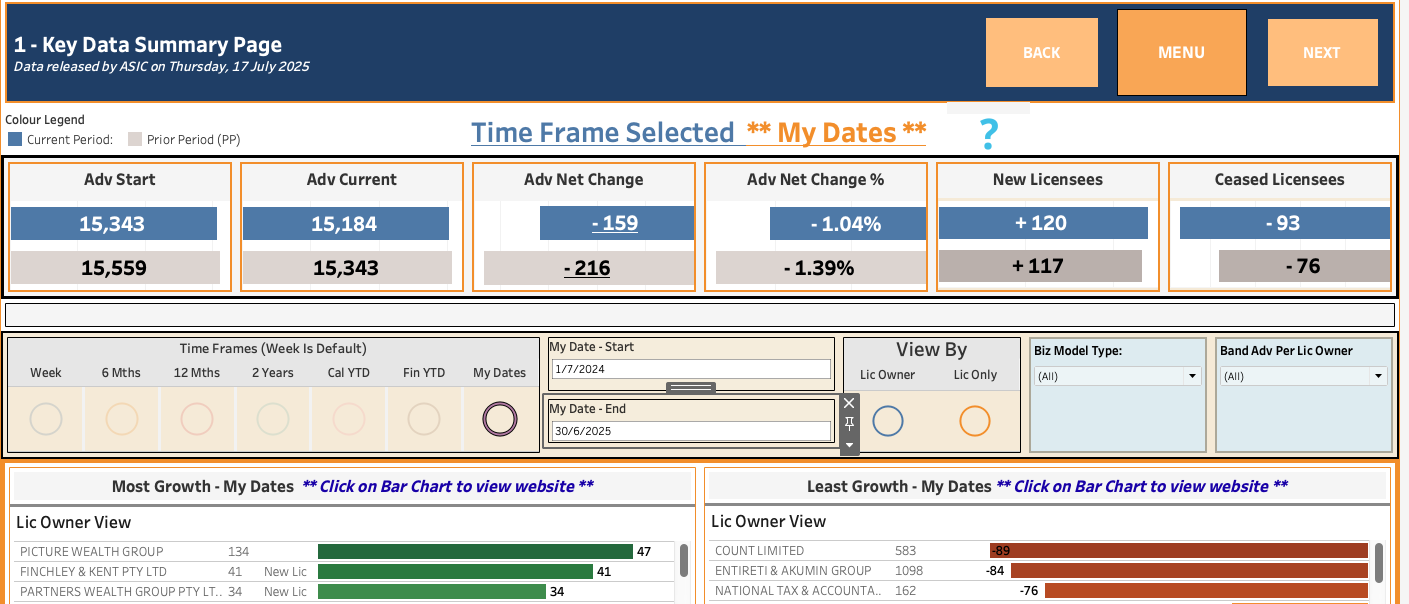

The ‘screenshot’of our Dashboard 1 from our Adviser Fast Facts series of dashboards, highlights the financial year versus the previous 2023/24 year shown as My Dates.

The current period (blue), highlights that the net loss for the financial year is currently showing a loss of (-159) compared to (-216) for the previous financial year. The number of new licensees is 120 with (-93) ceasing. 2023/24 shows 117 new licensees but a smaller amount ceasing at (-76).

The top three licensee owners for growth being Picture Wealth after an acquisition, a new licensee Finchley + Kent and another new licensee Partners Wealth Group who moved away from Entireti & Akumin Group.

As for the losses, Count Limited have the highest net losses. However, (-64) of the lost advisers are from Merit Wealth which mostly authorises ‘limited advice’ advisers. Entireti & Akumin Group with most losses of (-43) from Akumin previously known as AMP Financial Planning, and lastly the NTAA (SMSF Adviser Network) down by (-76).

Snapshot of the last Financial Year 2024/25

When we look at the various business models, the numbers do change quite dramatically between them. As you can see from the data from Dashboard 6 of Adviser Fast Facts shown below.

The largest business model - Financial Planning, (licensees that offer mostly holistic advice) was up by 11 advisers, opened 101 new licensees with only (-48) ceasing.

The Accounting - Limited Advice model (licensees that offer mostly limited SMSF advice) lost (-168) advisers with only the one new licensee and (-14) closing. The (-168) of losses is actually greater than the total net loss across all business models of (-159).

Snapshot of the last financial year2024/25 by Business Model

Wealth Data Acquired By Padua Solutions

You may have read in the financial press this week that Padua Solutions acquired Wealth Data. It is an exciting time to be joining Padua. As noted in the Padua announcement via LinkedIn/AFR - “We’re excited to welcome Wealth Data to the Padua family, enhancing the intelligence behind our platform and powering even smarter, more scalable advice solutions”.

I will continue to be working with Padua, looking to expand and build on what we have achieved to date. Any questions, please reach out via our contact details.