Financial Adviser Market Insights, July 24, 2025

Adviser Numbers Increased By +16 For The Week, Moving From 15,339 To 15,355

Click Here Free Adviser Movement Dashboard

Another good week with 16 more advisers. July’s total gain is +175. Calendar year to date is still in the red by (-117). Ten new entrants (advisers) started, and three new licensees joined, including one returning after a short break.

Banned Advisers on the rise? This week we take a look at the number of advisers being banned and see if it is on the rise. Details shown below.

Need More Data - Sign Up Today For Just $39.00

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements For This Period

Net change of advisers +16

Current number of advisers at 15,355

Net Change Calendar 2025 YTD (-117)

Net Change Financial YTD (2025/26) +175

32 Licensee Owners had net gains of 43 advisers

16 Licensee Owners had net losses for (-25) advisers

3 new licensees and zero ceased

10 new entrants

Number of advisers active in this period, appointed / resigned: 62

Growth - Licensee Owners

A new licensee commenced with four advisers who were previously at Fortnum Private Wealth owned by Entireti & Akumin (Details given to members)

WT Financial Group with another good week, up by three including two new entrants and one adviser coming back into advice after a break of several years. WT Financial Group have had the strongest start of all licensee owners for the new financial year, up by +16 advisers

Five licensee owners up by two:

Walker Lane both advisers previously at ASV Financial Services

PKF Wealth Newcastle, both being new entrants

A new licensee, advisers previously at Advice Loop owned by Dean Financial Group

Canaccord Group with both advisers leaving Bell Group

Alteris Financial Group with one adviser leaving Australian Financial Freedom and the other from The Advice Exchange.

A tail of 20 licensees up by net one including; Spark Financial Group, Picture Wealth and Centrepoint.

Losses - Licensee Owners

Entireti & Akumin Group down by six, with four leaving to form a new licensee. Another three have exited but yet to be appointed elsewhere and gained one new entrant.

Bell Financial Group down by two, as mentioned above, both joining Canaccord

Sequoia Group also down by two, neither appointed elsewhere to date.

A short tail of 11 down by net one each including Shaw and Partners and Advice Evolution.

Are Financial Adviser Banning and Disqualifications on the Rise?

It feels at times that barely a day goes by without seeing a ‘newsflash’ from ASIC and media outlets that another financial adviser is banned / disqualified. Is the current stream of ASIC disciplinary actions (DAs) on the rise or is it just a typical year across the financial adviser market?

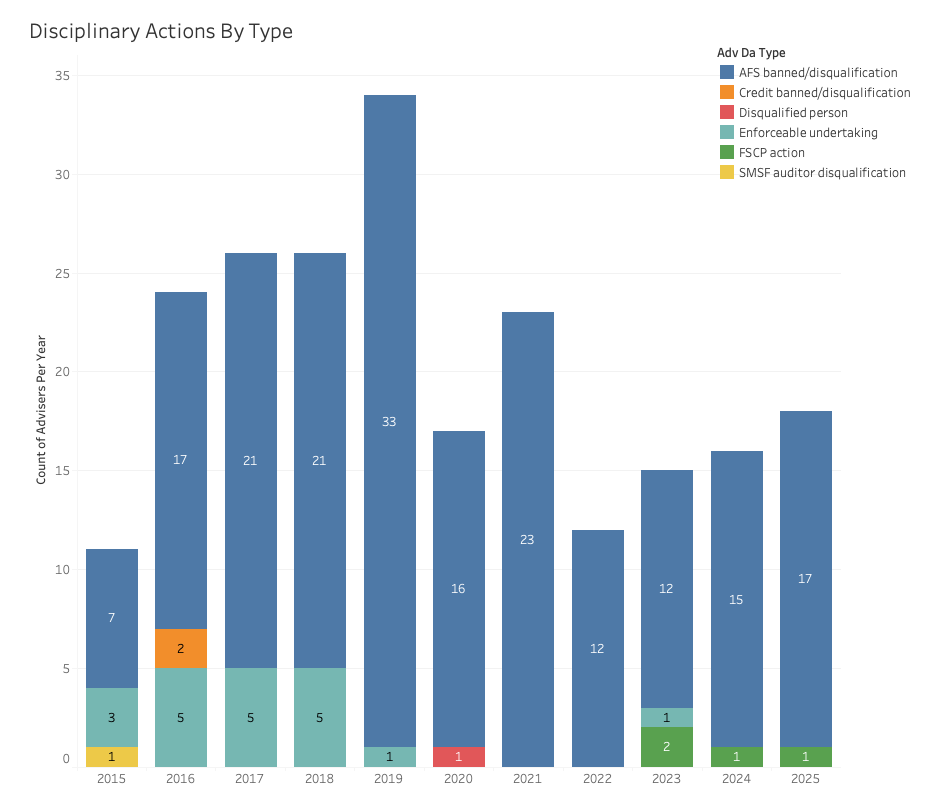

We have analysed the DAs issued by ASIC and compared them year by year back to 2015. The DAs chart below highlights the following:

2025 is showing a total of 18 DAs and we’re only just past the halfway point of the year. 18 is the highest number since 2021 which had a total of 23

2019 had the greatest number of DAs at 34, and the previous two years of 2017 and 218 were also high, both at 26

Given 2025 is currently at 18, and continuing uncertain events in the wealth / adviser market, 2025 could well be on track to end up above the 2019 figure.

Worth noting that In 2019, the total number of advisers on the ASIC Financial Adviser Register was significantly greater than today. 2019 started with 27,925 advisers and ended with 23,495. Currently, there are only 15,335 advisers on the FAR.

Total number of advisers affected by some form of disciplinary action since 2015

The chart below highlights a breakdown of the DAs by each year. The vast majority are deemed as being Banned/Disqualified, followed by some Enforceable Undertakings

DA types by advisers since 2015

How many advisers survive an ASIC Disciplinary Action?

Most of the affected advisers are no longer listed on the FAR. Since 2015, 217 advisers have been affected by a DA. Only 15 are still ‘current’. Two advisers with DAs in 2025, remain current despite recent bans. This is probably a timing delay, and they will likely soon be removed from the FAR.