Financial Adviser Market Insights, November 20, 2025

Adviser Numbers decreased By -9 For The Week, Moving From 15,467 to 15,458

Click Here Free Adviser Movement Dashboard

Over the week, the net number of financial advisers decreased by nine. Nine new entrants commenced on the ASIC Financial Advisers Register (FAR). There were no new licensees for the week and none ceased. No Licensee Owner gained more than one adviser this week.

This week, we continue from last week’s analysis of how many times advisers have been appointed. We now divide advisers into groups based on appointment numbers. For example, more than 4,000 advisers have been appointed to just one licensee.

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

Key Adviser Movements For This Period

Net change of advisers -9

Current number of advisers 15,458

Net Change Calendar 2025 YTD (-14)

Net change 2025 YTD of +141 when excluding licensees that provide mostly limited SMSF advice

Net Change Financial YTD (2025/26) +288

Net change Financial YTD +305 when excluding licensees that provide mostly limited SMSF advice

18 Licensee Owners had net gains of 18 advisers

21 Licensee Owners had net losses for (-29) advisers

There were no new licensees, and none ceased

9 new entrants

Growth - Licensee Owners

All Licensee Owners that gained advisers increased by just one

There were no new licensee owners this week

Losses - Licensee Owners

Vivid HoldCo Limited (Viridian) decreased by three advisers, none appointed elsewhere to date

Four Licensee Owners decreased by two advisers each -

Art Group Services Ltd - Non appointed elsewhere

Count Limited, one appointed at Centrepoint and the other two yet to be appointed elsewhere

Fiducian Financial Group both not appointed elsewhere

Stellan Capital Group Pty Ltd both not appointed elsewhere

16 licensee owners lost one each, including Viola Group Holdings Pty, FP Advice Pty Limited and Findex Group.

No Licensee Owners closed this week.

Number of times Advisers have been appointed

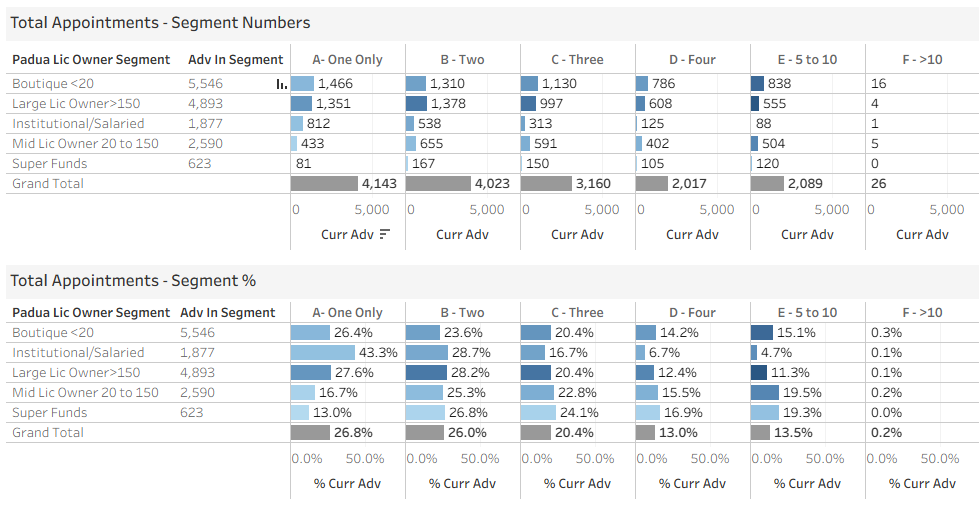

Following on from last week blog post, whereby we focused on the average number of times advisers had been appointed in each business segment, this week we highlight actual number of appointments.

The two tables below show numbers on top and percentages below. They reveal that 4,143 advisers (26.8%) have only one appointment, the largest group. The next largest group is advisers with two appointments at 4,023 (26.0%).

The largest share of the ‘Padua Lic Owner Segment’ (see below for breakup), for one appointment is the Institutional / Salaried sector, with 43.3% of their advisers appointed only once. Next is the Large Lic Owner with over 150 advisers at 27.6%. The smallest is Super Funds at 13.0%.

At the other end, 2,089 advisers (13.5% of all advisers) have been appointed five to ten times. The highest shares are Mid Lic Owners (20 to 150 advisers) at 19.5% and Super Funds at 19.3%. Large Lic Owners (>150 advisers) are lower at 11.3%.

Since the end of 2018, many financial advisers have left, and many licensees, especially those owned by banks, have closed or merged. Despite this, over 50% of current advisers on the FAR have only had one or two appointments (26.8% have one appointment and 26.0% have two).

. Average number of times that current advisers have been appointed.

Padua Licensee Owner Segments

Boutique: Firms with fewer than 20 advisers. If a licensee has fewer than 20 advisers but is owned by a group with more than 20, it’s not counted here. Includes all advice types.

Large Licensee Owner >150: Firms with over 150 advisers, often spread across several licensees they own. Advisers usually work in practices that operate like independent businesses under licensee

Mid Licensee Owner, 20–150: Similar structure but with 20 to 150 advisers.

Institutional / Salaried: Firms mostly employing salaried advisers. This excludes super funds and licensees with fewer than 20 advisers.

Super Funds: Mainly industry super funds with at least 20 advisers. Also includes groups like Industry Fund Services that provide advisers / services to super funds.

Note: The information has been taken from the ASIC Financial Adviser Register (FAR). Not all advisers may have recorded their entire history on the FAR.