Your Essential Guide To The

Financial Advice Landscape

Comprehensive Databases, Insightful Dashboards and Expert Analysis

Book A 45 Min Video Call For A Demo And Pricing - Click Here

Members Lounge and Blue Book

Access a great range of dashboards highlighting financial adviser movement, skills, experience and much more. We also have Adviser and AFSLs databases that are super quick and easy to use, allowing users to find the people they want.

Financial adviser client segmentation tool - Superannuation and SMSF dashboards

Start your membership for only $39.00

‘Free’ Adviser Movement, Adviser Client Segmentation and Superannuation Dashboards

Access Via ‘Free Dashboards’ in Top Menu Bar

First Month Now Only $39.00 Selecting 'YEARLY' cost is only $950

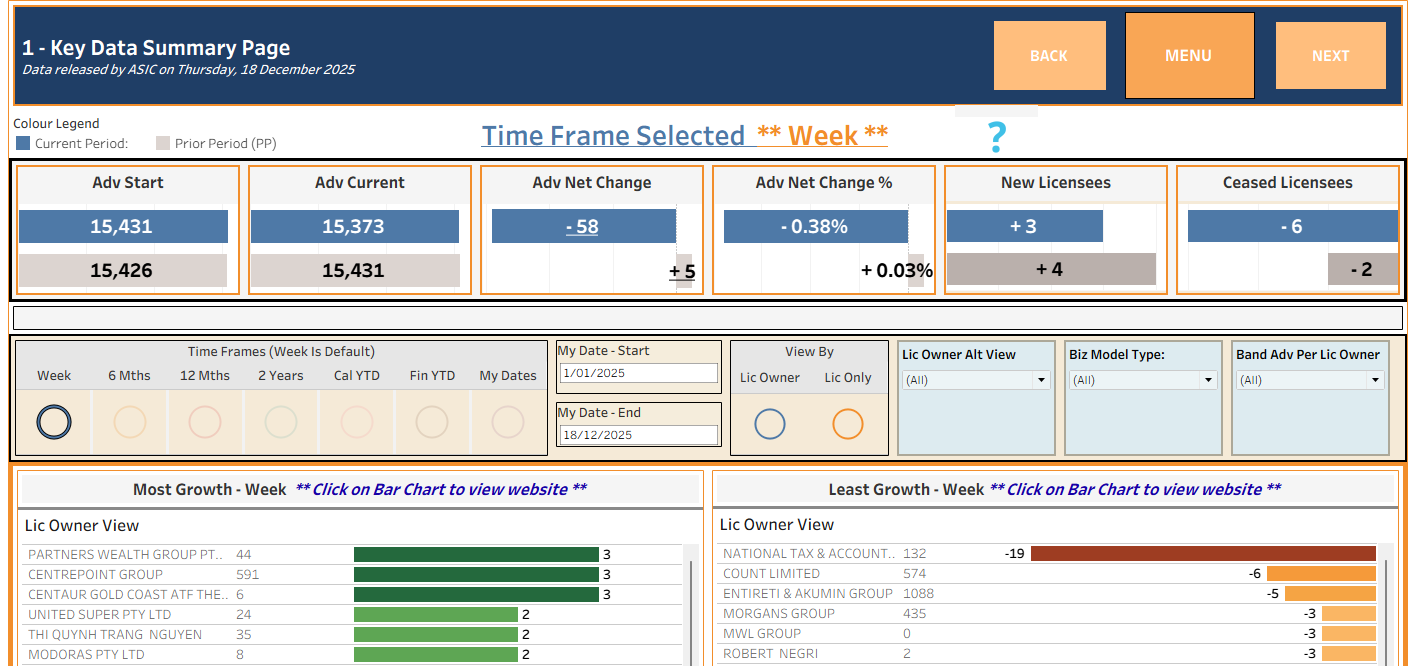

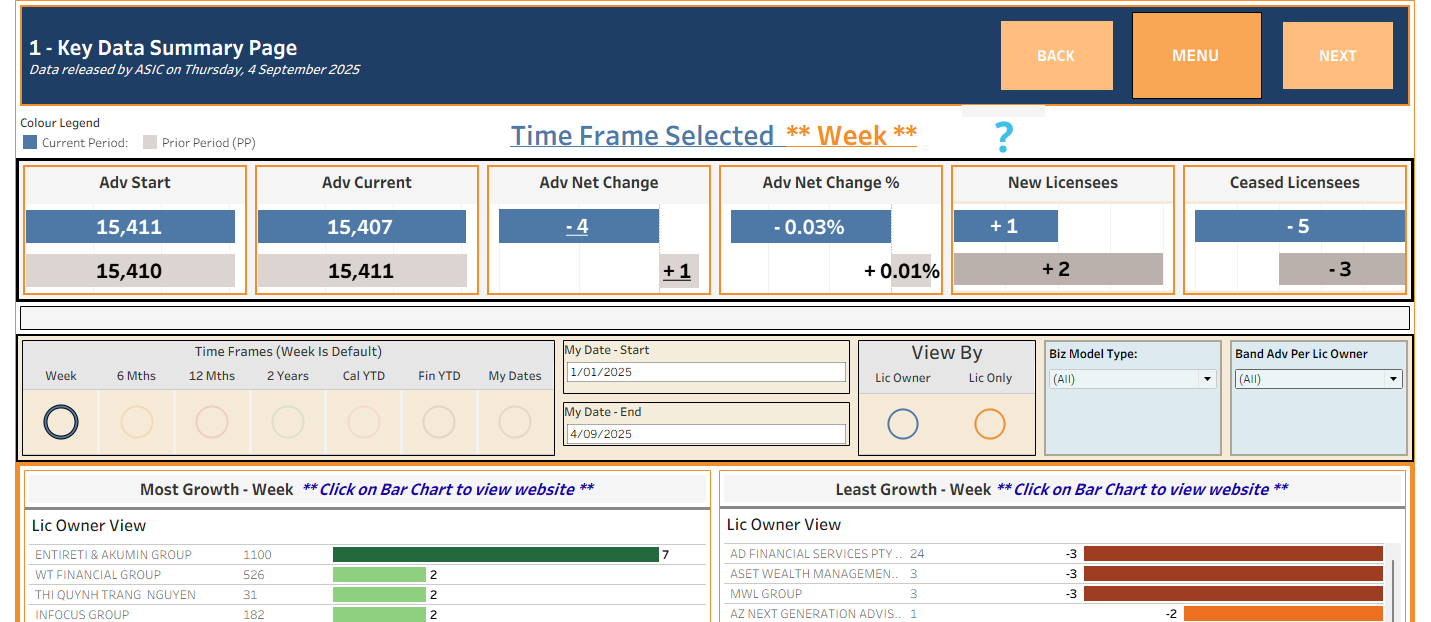

Despite 25 new entrants, the net number of advisers dropped by 58. A busy week with over 190 adviser affected and 66 licensee owners had a net drop in their adviser numbers.

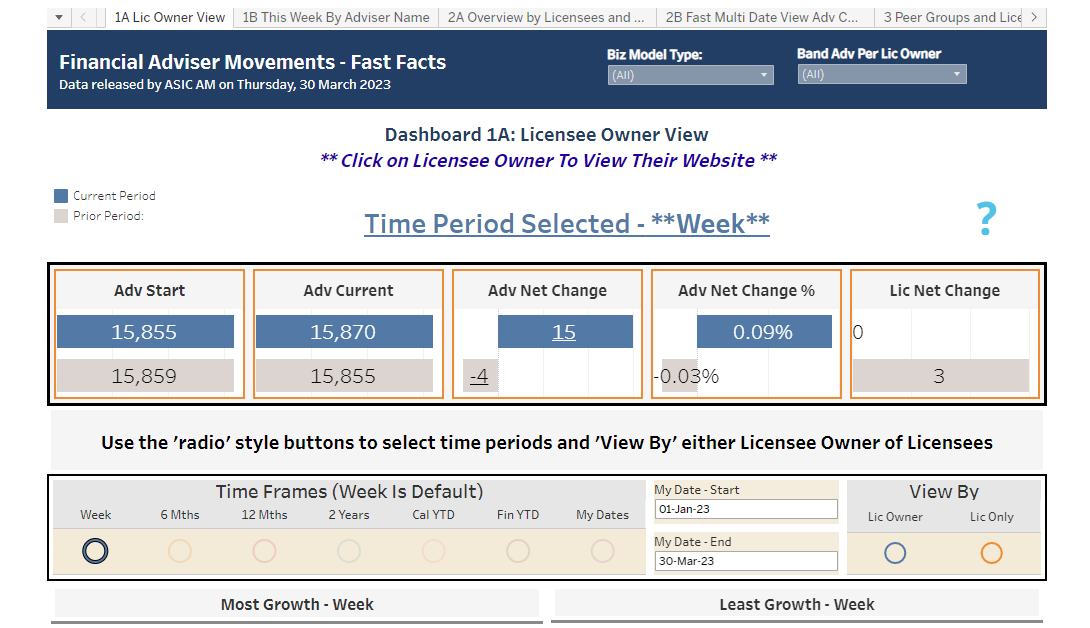

The data showed a net gain of five advisers, including 14 new entrants. Four new licensees also began. Analysis of the Financial Adviser Exam

Weekly data shows the largest drop in adviser numbers since June, with 32 fewer advisers. Our analysis of super by fund type has been updated.

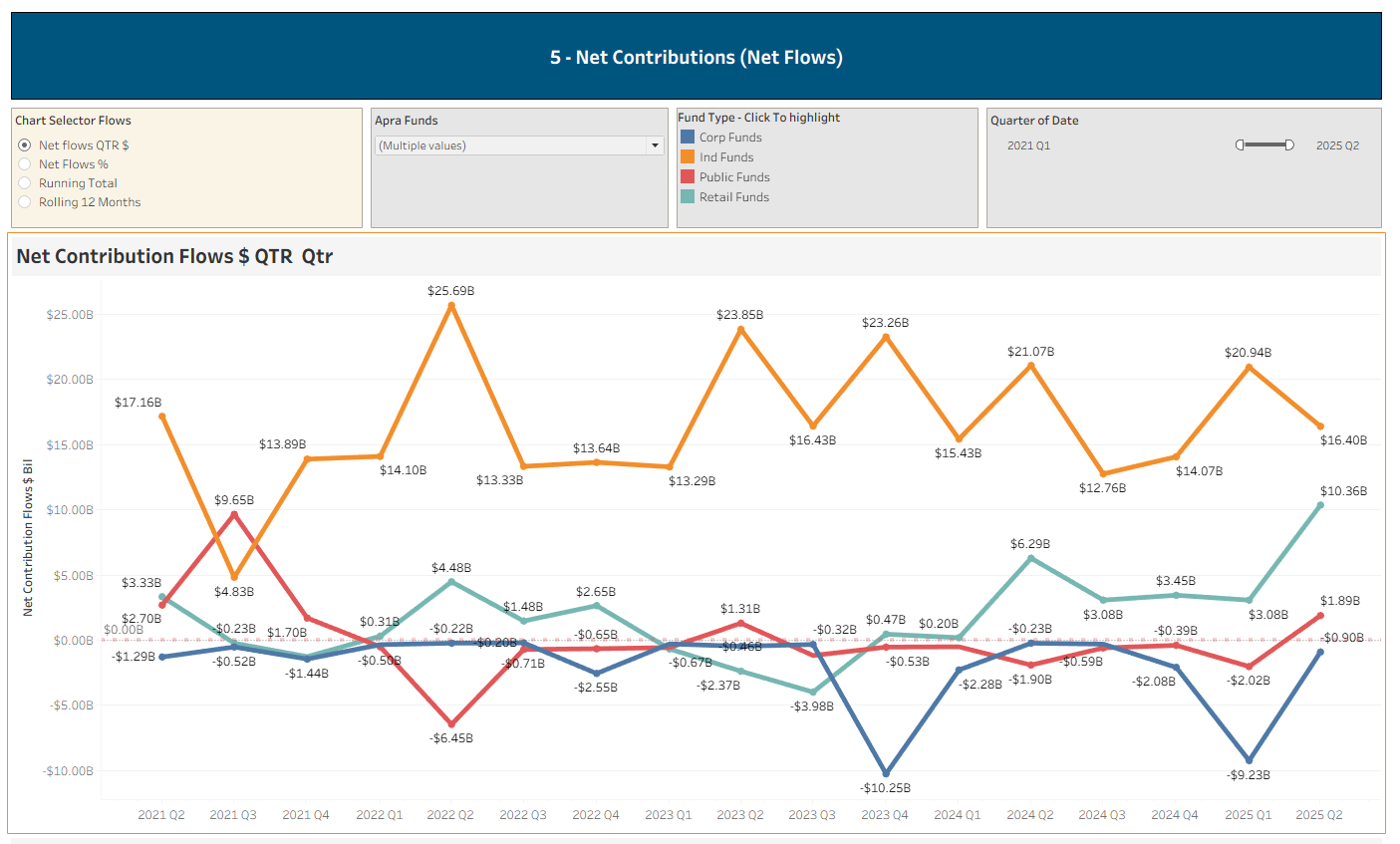

Industry Funds still dominate the market despite a drop in net contributions and increased loss of funds to SMSFs

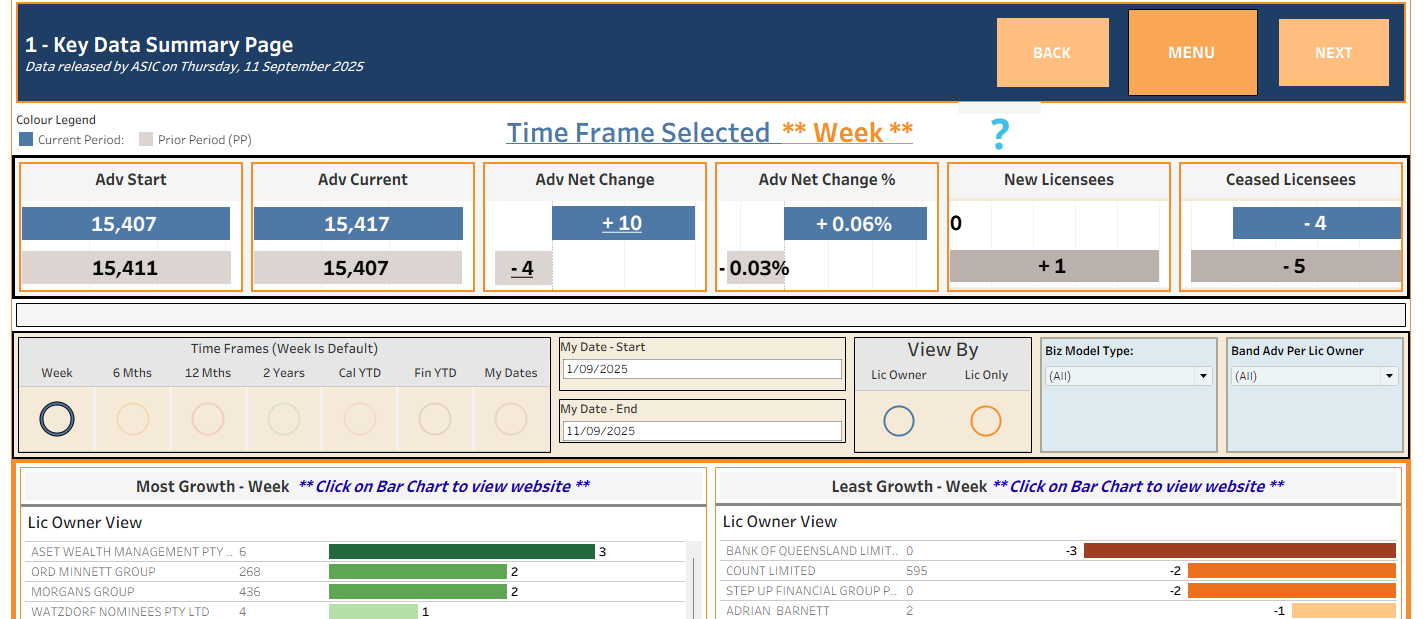

The net number of advisers increased by just one despite 10 new entrants. Analysis to the Experienced Pathway and Qualifications.

New ASIC data on the Experienced Pathway and 2026 qualifications shows a sharp drop in adviser numbers at the start of 2026.

The number of advisers increased by (-9). We take another look of the number appointments at licensees by advisers.

The number of advisers increased by nine. We review the average appointments per adviser for each business model.

A net loss of five advisers this week despite nine new entrants. Have large advice groups found their mojo?

Moderate growth of six despite 17 new entrants commencing this week Q3 of 2025 analysed.

A slight drop in advisers during a busy week. Experienced Pathway progress shows some irregularities.

A big jump in the number of advisers of 24. We also show who is hiring the new entrants.

Advisers numbers up by just one despite eleven new entrants. How many advisers can offer specific advice.

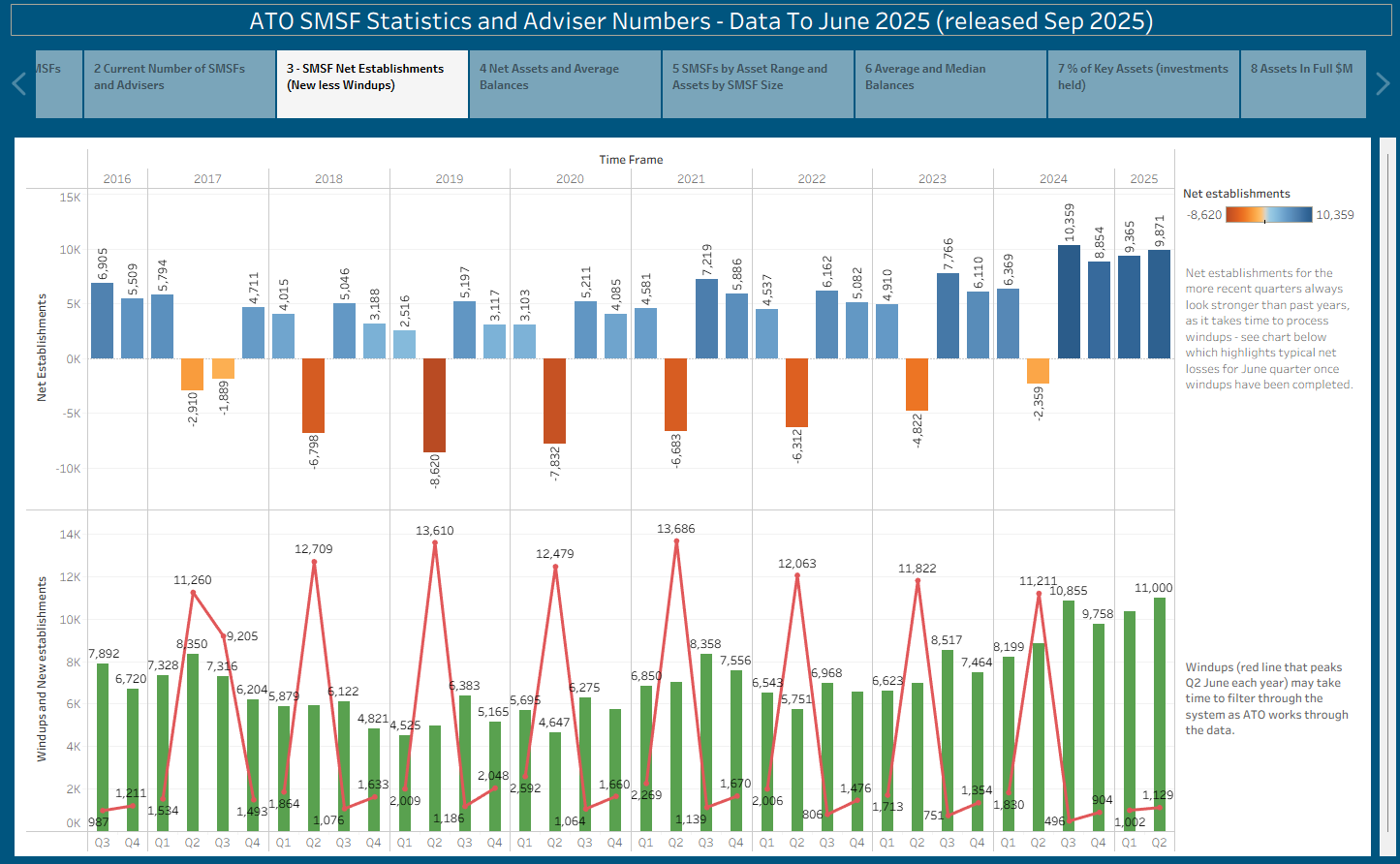

The ATO SMSF Statistics updated to June 2025 - Record growth of establishments but negative net flow of funds is on the increase.

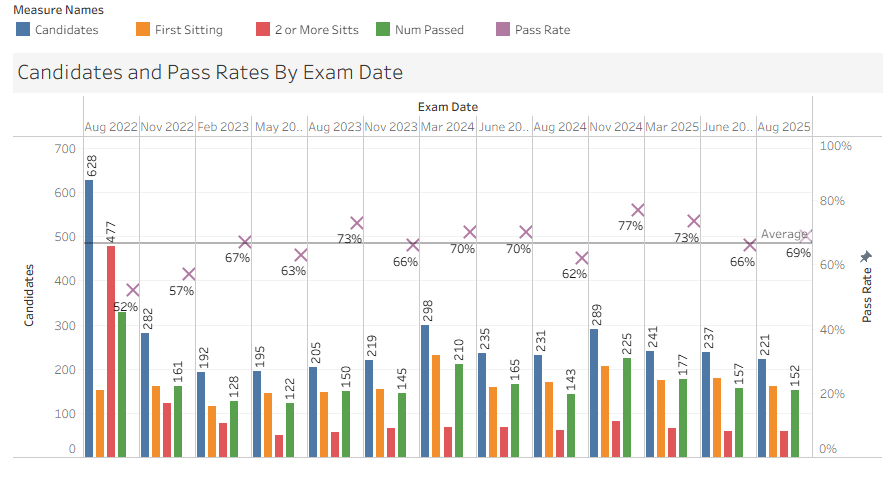

Number of advisers pick up with a surge of new entrants. Link to Financial Adviser Exam analysis included.

Analysis of the August 2025 ASIC Financial Adviser Exam shows that the number of Financial Exam candidates and passes have slowed down.

The latest APRA Super Funds data shows a strong quarter for Retail Funds, while Industry Funds remain the dominant force.

The ATO SMSF Statistics updated to September 2025 - Record growth of establishments but a slight dip for average balances.